Common Obstacles in Cash Home Purchases

By Danny Johnson | Updated 2/28/2025, 9:11:50 AM

Discover the common pitfalls cash buyers face when purchasing a home. Learn how to navigate delays in closing and the pros and cons of paying cash.

- Key Takeaways

- Financial Hurdles in Cash Transactions

- Wire Transfer Complications

- Cash Flow Issues and Market Volatility

- Hidden Costs and Closing Expenses

- Legal and Documentation Challenges

- Title Search Problems

- Property Survey Issues

- Tax-Related Complications

- Property Inspection and Valuation Issues

- Home Inspection Findings

- Property Condition Disputes

- Final Walkthrough Problems

- Third-Party Delays and External Factors

- Escrow Company Delays

- Title Company Processing Times

- Recording Office Complications

- 20+ Years of Experience Helps Danny Buys Houses Avoid These Obstacles

🗂 Table of Contents

Imagine finding the perfect house, a charming property that could be your dream home. You've decided to make a cash offer, thinking it will make the process easier and make you a more competitive buyer. This is what every home seller dreams of – a simple, straightforward cash transaction!

But then, reality hits. You start facing common obstacles in cash home purchases that could send you back to square one. From unexpected financial issues to delays with title companies, the journey isn't always easy.

Since cash offers are attractive in the real estate market, many sellers jump at the chance. But as a cash buyer, it's important to know about potential problems. Even if your cash offer seemed like the perfect solution, you might still face challenges.

Have you ever felt overwhelmed by the details of a cash purchase? Especially in a fast-paced market where homes sell quickly? If so, you're not alone.

If you are wanting to sell, there are companies like Danny Buys Houses that pay cash for houses in San Antonio, Texas

This article will explore the common hurdles in cash transactions. It aims to help you prepare for your journey to homeownership.

Key Takeaways

- Understanding cash transaction challenges can help streamline the process.

- Cash offers are often viewed favorably by home sellers.

- Be prepared for possible delays due to third-party services.

- Hidden costs can surprise even seasoned buyers.

- A knowledge of legal documentation is crucial for a smooth purchase.

- Market conditions can significantly impact the buying experience.

Financial Hurdles in Cash Transactions

When you dive into cash transactions for home purchases, recognizing financial hurdles is key. Challenges can arise even in what seems like a straightforward process. One significant area to consider involves wire transfer complications. Many buyers expect swift money transfers, but the reality can differ greatly.

You might find yourself waiting several days for the funds to clear. Consider the potential impact on your closing schedule if the wire doesn’t arrive in time.

Wire Transfer Complications

Wire transfers are often the backbone of cash transactions. Mistakes can lead to funds being sent to the wrong account, disrupting your financial transaction. To avoid such setbacks, it’s wise to double-check all the details with your bank ahead of time.

Confirming the transfer timeline can relieve stress and help keep the process on track.

Cash Flow Issues and Market Volatility

Cash flow issues can emerge unexpectedly, especially in the current climate of market volatility. Prices fluctuate, potentially affecting your ability to secure a favorable purchase. Cash buyers must stay alert to changes that could affect their budget and ultimate purchasing power.

By being proactive, you can navigate these uncertainties more effectively.

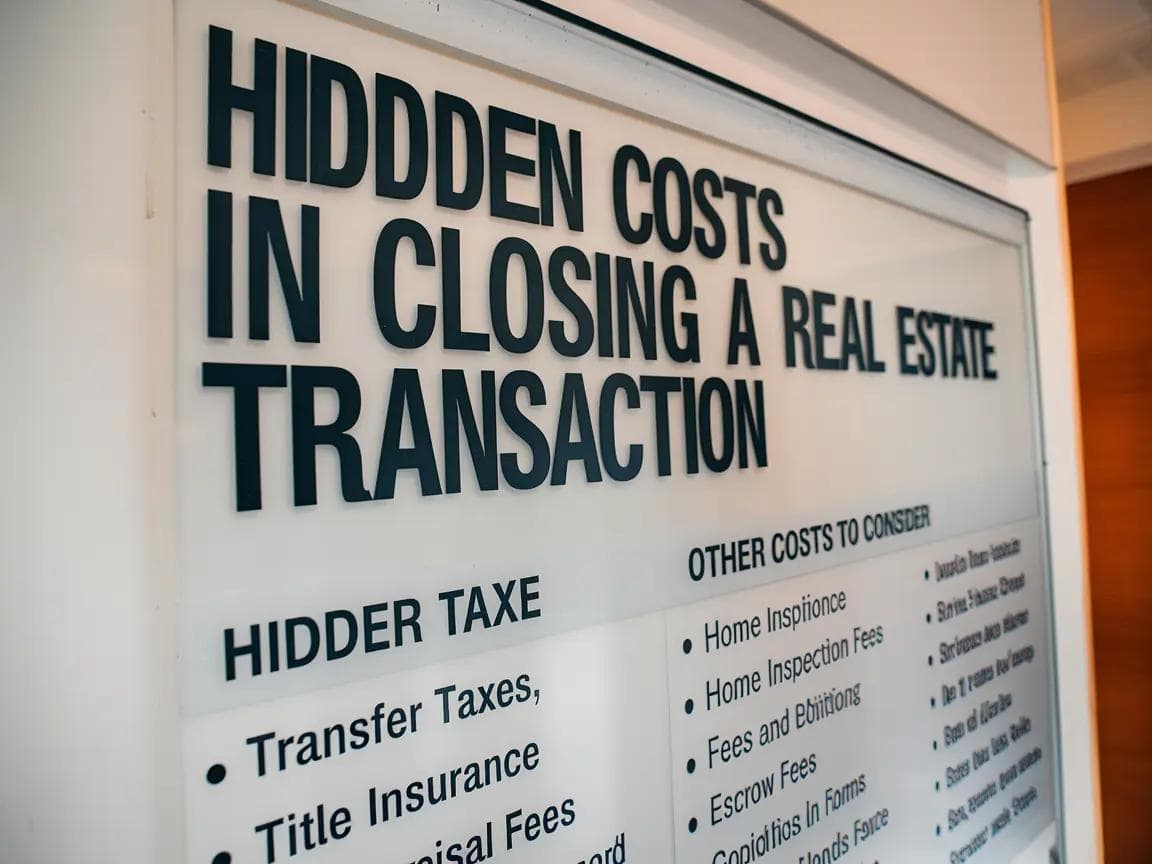

Hidden Costs and Closing Expenses

Don't forget about hidden costs associated with the purchase. Though cash transactions often eliminate various financing fees, closing expenses can add up quickly. These costs typically include title searches, inspections, and other obligatory fees that arise during the homebuying process.

As a buyer, it’s crucial to budget for these expenses to prevent any unexpected financial strain at closing.

Legal and Documentation Challenges

Exploring cash home purchases can lead to legal and documentation hurdles. It's key to know these challenges for a smooth deal. Title search problems can reveal unexpected issues. Understanding these helps you tackle the real estate journey's complexities.

Title Search Problems

A thorough title search is crucial before buying. If the title company finds liens or claims, it can threaten your ownership. A detailed title search protects you from hidden problems, ensuring a clear title.

Property Survey Issues

Getting a current property survey is essential to avoid disputes. Inaccurate surveys can lead to boundary issues with neighbors or authorities. An accurate survey safeguards your investment and prevents tax problems from unclear lines.

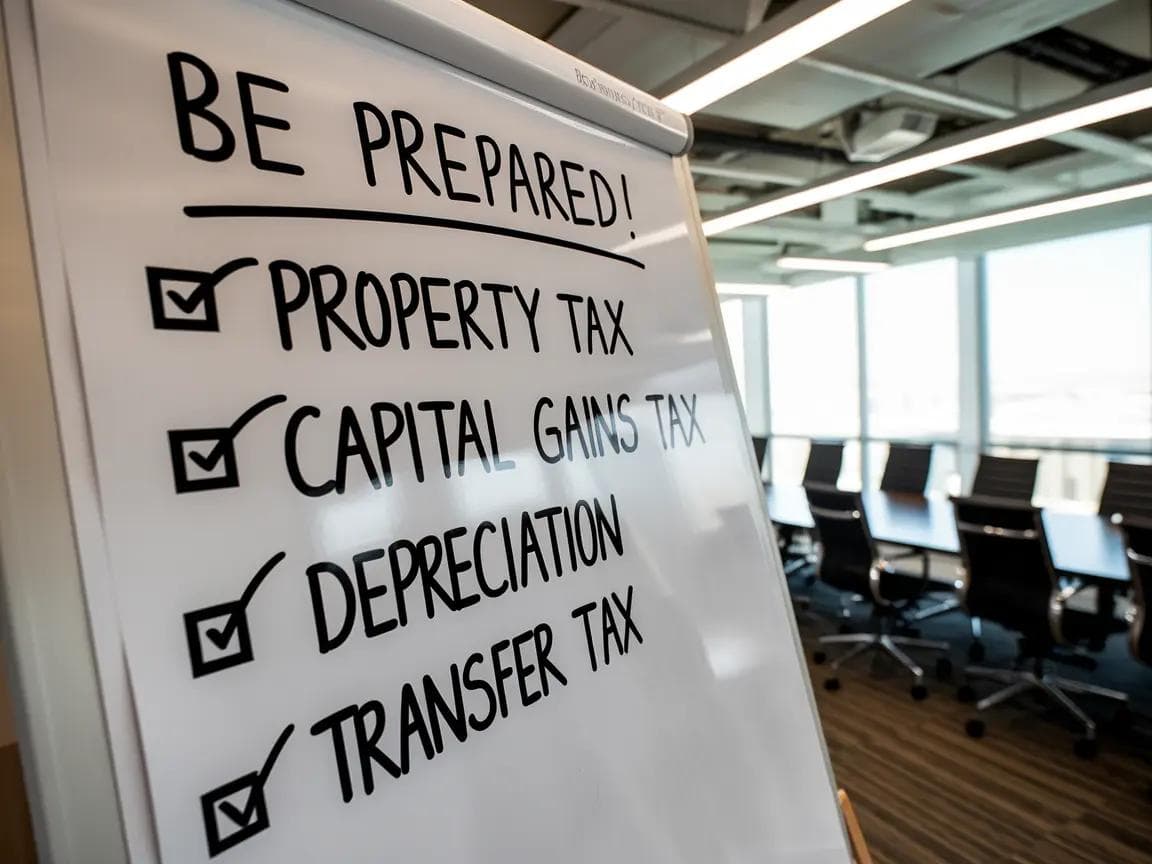

Tax-Related Complications

Tax issues often surprise sellers. Unpaid property taxes can block the closing. Knowing your tax obligations and having all documents ready is vital before buying. Tackling tax concerns early avoids stress and ensures a smooth closing.

Property Inspection and Valuation Issues

When buying with cash, knowing about property inspections and valuation is key. Buyers often face challenges, especially with home inspection results. These can reveal safety hazards, structural problems, and issues with plumbing and electrical systems.

Because of this, buyers might change their offers. It's common for them to negotiate repairs or ask for a lower price.

Home Inspection Findings

Some cash buyers skip home inspections to speed up the process. But, this can be risky. Undetected problems can lead to big repair costs later.

Home inspections usually cost between $300 and $500. This is a small price compared to what you might find. If issues are found, buyers often negotiate repairs or a lower price.

Property Condition Disputes

After getting the inspection report, buyers might disagree about the property's condition. Inspectors check major parts like roofs, foundations, and HVAC systems. These can greatly affect the property's value.

Having a good inspector is crucial. They can estimate repair costs, helping buyers prepare for talks. If big problems are found, an inspection contingency can protect buyers. It lets them back out if major issues are discovered.

Final Walkthrough Problems

The final walkthrough is very important in cash purchases. It's the last chance to check the property before buying. Any new problems found can change a buyer's mind, sometimes delaying the sale.

It's important to make sure all repairs were done and the property is as expected. Thinking carefully about valuation issues during this time helps buyers make good choices.

Third-Party Delays and External Factors

In the world of cash transactions, many outside factors can slow things down. The escrow and title companies are key players. Delays can cause big headaches and push back your closing date.

Escrow Company Delays

Escrow company delays can really slow you down. They make sure everything is right before money changes hands. If they're too busy or run into problems, you'll face delays. These escrow delays can push your closing date further away.

Title Company Processing Times

The title company's time is important to watch. They do deep title searches to check for any issues. About 20% of delays come from title problems. Managing these can save you a lot of time.

Recording Office Complications

When it's time to close, the recording office takes over. But, they can get backed up, especially when it's busy. It's key to keep an eye on the paperwork and know what might slow things down.

Third-party delays are a part of real estate. To learn more and find ways to handle these issues, check out this resource on issues that could delay your real estate.

20+ Years of Experience Helps Danny Buys Houses Avoid These Obstacles

Danny Buys Houses has over 20 years of experience in the cash home buying business. We understand the challenges that experienced homebuyers face. Our real estate expertise helps us overcome these obstacles, making the process smoother for our clients.

Buying a home quickly can be tough, with many potential problems. Our team offers strategic advice to help you through these challenges. This advice includes dealing with property inspections and appraisal issues, making your journey less stressful.

At Danny Buys Houses, we know how important this is for you. We use our experience to avoid common problems and ensure a smooth process. Ready to explore your options? Learn more about our process and make your home-buying journey a success!

Frequently Asked Questions

In this section we will answer the most common questions to Common Obstacles in Cash Home Purchases

What are the typical financial documentation requirements for cash home purchases?

Although less extensive than financed purchases, buyers may need to show proof of funds, such as bank statements or a letter from their financial institution, to demonstrate they can cover the purchase price and any additional costs.

How can cash flow issues impact a cash home purchase?

Cash flow problems may arise if a buyer lacks liquid assets to cover unforeseen expenses like repairs or closing costs after using most of their available funds for the purchase. This can delay or complicate the transaction.

Are there potential legal obstacles when purchasing a home with cash?

Yes, buyers might encounter title issues, liens on the property, or zoning violations that must be resolved before closing. Conducting thorough due diligence and hiring a real estate attorney can mitigate these risks.

How does paying in cash affect negotiation power and pricing in home purchases?

Cash offers can strengthen negotiation power by offering quicker closing times and fewer contingencies, making them attractive to sellers. However, this doesnt guarantee lower prices; market conditions and seller motivations also play significant roles.

What tax implications should be considered when buying a house with cash?

Buyers should consider property taxes, capital gains tax obligations upon resale, and potential gift tax implications if receiving funds from others. Consulting with a tax professional is advisable to understand specific scenarios.

What is a primary financial obstacle when purchasing a home with cash?

The main financial obstacle is ensuring sufficient liquidity. Buyers need to have enough liquid assets available without disrupting their overall cash flow or other financial obligations.

How does lack of financing contingencies impact negotiations in cash purchases?

Without financing contingencies, sellers might prefer cash offers over financed ones; however, it reduces leverage for buyers to back out of deals if unforeseen issues arise after inspection.

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.