How To Sell an Inherited House in Texas [Updated 2024]

By Danny Johnson | Updated 12/5/2024, 4:54:48 PM

Sell an inherited house in Texas by following our recently updated guide for 2024 and the changes in the market.

- Selling an Inherited House Fast in Texas in 2024

- Navigating Probate Without a Will in Texas

- The Deceased Left a Will

- Can You Sell An Inherited House Before Probate

- What About Capital Gains When You Sell An Inherited House in Texas

- Sell Inherited Real Estate In Texas

- Deciding To Sell Your Inherited Property For Cash: A Closer Look

- Conclusion

🗂 Table of Contents

Are you inheriting a house in Texas in 2024?

Have you inherited a house already?

Would you rather sell that house for cash than make repairs, pay taxes, manage tenants, etc?

If you answered yes to these questions, this article will help you sell that inherited house fast so that you can get on with your life. Plus, having extra money in the bank doesn't hurt either! ;)

Selling an Inherited House Fast in Texas in 2024

Selling inherited property can be done very quickly in most cases.

How you go about selling the house depends on where you are at in the probate process.

What needs to be done depends upon whether the deceased has left a will.

Navigating Probate Without a Will in Texas

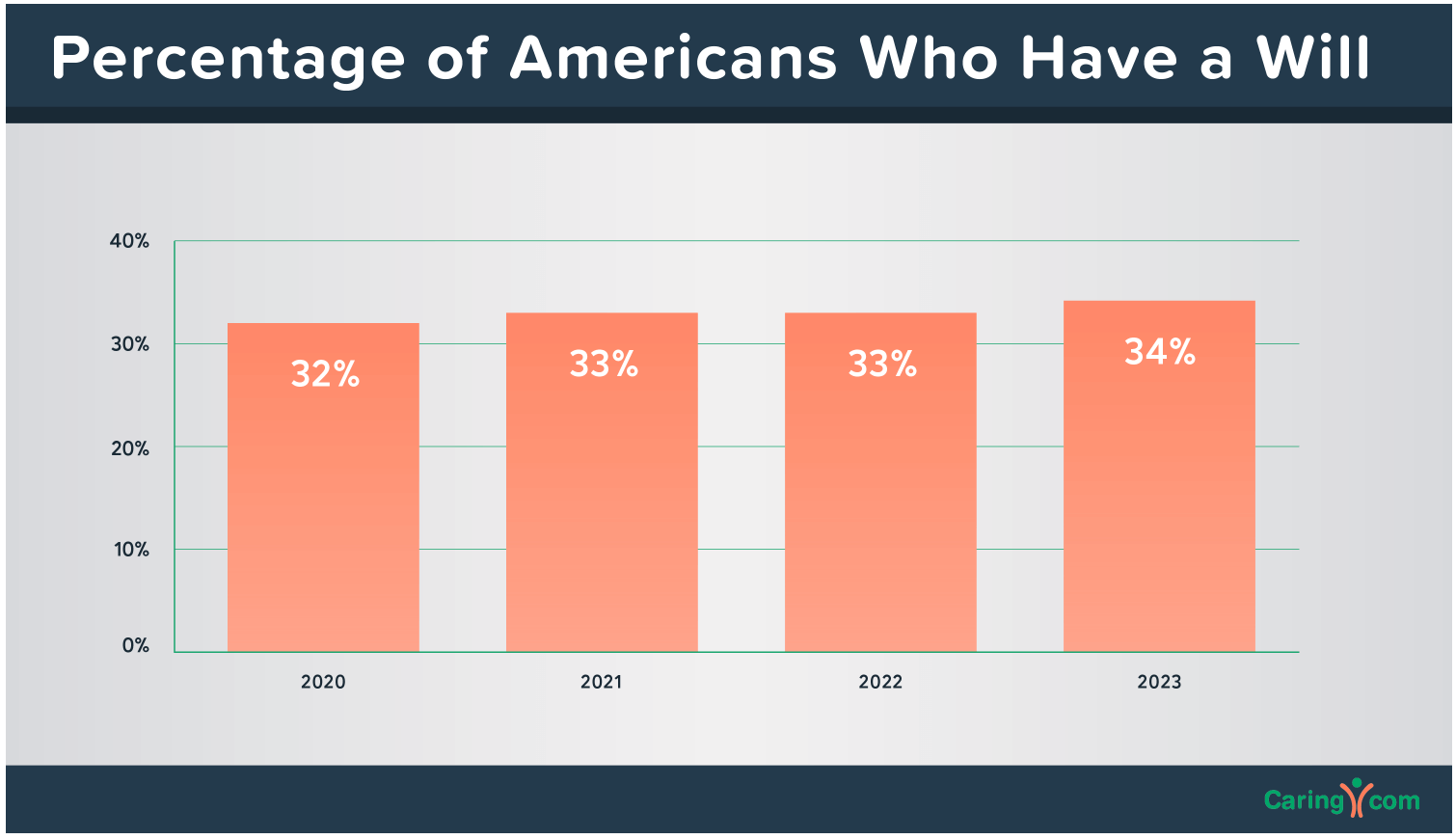

Image source: Caring.com

Drawing from my experience helping clients in San Antonio navigate the complexities of inheriting property without a will, I've seen firsthand how the absence of estate planning, a scenario echoed by a 2023 Caring.com study revealing two-thirds of Americans lack any estate document, complicates matters.

In Texas, an Affidavit of Heirship becomes a critical tool.

This document, which I've successfully filed on numerous occasions, simplifies the process by identifying the deceased's heirs, eliminating the need for a drawn-out probate process. This is how to sell a house without probate quickly.

This approach, available to our local court system, underscores the importance of understanding regional legal nuances.

Avoiding the normal probate process will save you a ton of time and effort. Title companies can use the affidavit of heirship to handle the transaction when you sell the house.

This is the quickest way to sell an inherited house in Texas as long as the deceased did not leave a will and the real estate is in their name.

The Deceased Left a Will

If a will was left by the deceased, the probate process will need to be followed.

The 8 steps of the Texas probate process as detailed by Forbes Law Office are as follows:

- Filing

- Posting

- Will Validation

- Cataloging Assets

- Beneficiaries Identified

- Notifying Creditors

- Resolving Disputes

- Distributing Assets

Most of the time the probate process will need to have been completed for you to take the next step in selling the house. Next, we will discuss how it can be possible to sell a house before probate is completed.

Can You Sell An Inherited House Before Probate

Yes, it is possible to sell an inherited house before probate is completed.

Selling the house (real property) before probate has finished is a choice that can be made by the probate court. Only the probate court can allow this to happen.

If the Texas estate does not have a lot of assets and there is a reason to move quickly to sell the house (mortgage payments due, taxes owed, etc), the probate court is more likely to agree to allow the sale of the house right away.

What About Capital Gains When You Sell An Inherited House in Texas

Another aspect of selling an inherited house that needs to be considered is whether or not you will be required to pay capital gains taxes on the proceeds of the sale.

According to the law offices of Daniel Hunt:

If you own the inherited home for one year or less before selling it, the capital gain will be short-term and taxed as regular income. If you keep the property for more than one year, the long-term capital gains tax rate would be 0%, 15%, or 20%, depending on your income bracket.

So there are consequences to selling the house right away. If your tax bracket allows you the benefit of a low tax rate, this may not be much of an issue.

If you've already owned the house (after probate so that it's in your name) for more than a year, the lower long-term gains tax rate would be much easier to swallow.

The taxes you are responsible for when selling an inherited house largely therefore depend upon your tax bracket and how long you've owned the house.

Sell Inherited Real Estate In Texas

Selling an inherited house in Texas is usually handled like the sale of any other house. Many will list with a real estate agent. Many will sell for sale by owner.

If the house is terribly outdated and/or needs a lot of repairs, they methods of selling might not be optimal.

When this is the case, a cash home buyer is usually your best option.

Deciding To Sell Your Inherited Property For Cash: A Closer Look

In my two decades buying houses in the San Antonio, Texas market, I've bought over a hundred inherited properties.

Selling an inherited house to a cash buyer often is the most practical solution, especially for those looking to avoid making repairs.

Here's why:

- Financial Savings: My clients have saved significantly by avoiding Realtor commissions, which can amount to a substantial portion of the sale price. This advantage is particularly poignant for those who've inherited properties in less-than-ideal conditions, where every dollar counts towards settling the estate or future plans.

Realtor commissions are under fire right now because they inflate the cost of selling and buying a house. In fact, in December of 2023, the US Justice Department started a probe into the fees being charged and whether the situation amounts to a monopoly. - Simplification of the Sale: The traditional route of selling a home involves appraisals and inspections—steps that can uncover issues requiring costly repairs or even jeopardize a sale. I've guided sellers through cash transactions where such hurdles were bypassed, offering peace of mind and certainty.

Cash allows us to buy your house without having to have a professional appraisal and inspection. We perform our own inspections when we view the property. We value the property ourselves rather than hiring a professional. This ends up saving money that allows us to offer you more for the house. - The 'As-Is' Advantage: Perhaps one of the most compelling reasons to consider a cash sale comes from a situation involving a Texas home from the late '60s, burdened with outdated plumbing and electrical systems and a sloping foundation. The heirs, faced with the daunting task of fixing the property, opted for a cash sale, eliminating the worry of post-inspection negotiations or buyer fallout. One reason why people want to sell 'as is' is because this is a great way to sell a hoarder house. Most people do not want to go through and clean everything out. It is just too daunting a task.

- Speed of Transaction: The promise of closing within days, not months, is one of the top reasons people that inherited a house in Texas have sold to Danny Buys Houses.

A recent case saw a family able to settle an estate swiftly, distributing the assets within a couple weeks. This allowed everyone to move on with their busy lives with the benefits of the cash from the sale.

These insights stem from real-world experiences, underscoring the tangible benefits a cash sale can bring to those dealing with inherited properties. While each scenario is unique, understanding these advantages—and weighing them against your specific situation—is crucial.

Ready to get a cash offer for your inherited house in Texas? We buy houses cash and will gladly make you a fair cash offer.

Conclusion

In 2024, when inheriting a house in Texas, there are many things to consider. How the house is transferred into your name depends upon whether a will was left by the deceased.

Selling the house also has several considerations like how much in taxes you will be required to pay.

We hope this article helped answer your questions around these situations so that you are better equipped to sell your inherited house fast in Texas in 2024.

Frequently Asked Questions

In this section we will answer the most common questions to sell inherited house

What steps should be taken to sell an inherited house with an existing mortgage?

First, determine if you can assume or refinance the mortgage. Then, decide whether to sell as-is or make improvements. Finally, work with a real estate agent experienced in probate sales to navigate legal and financial complexities.

Are there any specific fees associated with selling an inherited property?

Yes, expect typical selling costs like real estate commissions (typically 5-6%), closing costs (2-5%), potential capital gains taxes, probate fees if applicable, and possible repairs or staging expenses.

Can I use proceeds from selling an inherited home to pay off its mortgage?

Yes, proceeds from the sale can be used to settle any outstanding mortgage balance. Ensure that all debts tied to the property are cleared before distributing remaining funds among heirs.

What advice do you offer about managing emotional aspects when selling an inherited home?

We suggest separating emotional attachment from financial decisions by setting clear goals for the sale process and possibly enlisting a neutral third party like a financial advisor for objective guidance.

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.