Can You Sell a House in Foreclosure in Texas?

By Danny Johnson | Updated 12/5/2024, 2:53:26 PM

Facing foreclosure in Texas? Sell your house instead! Avoid auction by contacting us for a consultation on selling your Texas home.

- Can You Sell a House In Foreclosure in Texas?

- Key Takeaways

- Understanding Foreclosure in Texas

- What is Foreclosure?

- The Texas Foreclosure Process and Foreclosure Timeline

- Legal Implications for Homeowners

- Rights of Homeowners During Foreclosure

- Legal Protections

- Lender Communication

- Foreclosure Prevention Options

- Can You Sell a House in Foreclosure Texas?

- Benefits of Selling a House Before Losing It To Foreclosure

- Protect Your Credit Score

- Avoid Deficiency Judgments

- Faster Path to Future Home Purchase

- Steps to Sell Your House During Foreclosure

- Challenges When Selling a House in Foreclosure

- Time Constraints

- Market Value vs. Mortgage Balance

- Dealing with Lenders

- Working with Real Estate Professionals

- Sell Fast to a Cash Home Buyer

- Alternative Options: Short Sales and Deed in Lieu

- Understanding Short Sales

- Pros and Cons of Deed in Lieu

- Comparing Alternatives

- Legal Considerations and Foreclosure Laws in Texas

- Yes, You Can Sell a House in Foreclosure in Texas

🗂 Table of Contents

Can You Sell a House In Foreclosure in Texas?

The fear grips your heart as you stare at the foreclosure notice. Your home now feels like a crushing weight. But in Texas, there's still hope. As a homeowner facing foreclosure, you're not alone. Many Texans have walked this path and found a way out. Selling your house during foreclosure might be the lifeline you need.

In the Lone Star State, the foreclosure process doesn't happen overnight. This gives you a chance to take control. You can sell your property before the bank does. It's a race against time, but one you can win with the right knowledge and quick action.

Facing foreclosure in Texas doesn't mean you've lost all options. The law provides some protections, and lenders often prefer to avoid the foreclosure process. By exploring the possibility of selling your house, you might find a way to protect your credit score and financial future. You can avoid and stop foreclosure. Let's dive into what you need to know about selling a house in foreclosure in Texas.

With this article, we hope to help you avoid foreclosure.

Key Takeaways

- Texas homeowners can sell their house before foreclosure is complete

- Acting quickly is crucial, especially if a foreclosure sale is scheduled

- Selling during foreclosure can help avoid credit score damage

- Understanding Texas foreclosure laws is important for homeowners

- There are options to work with lenders and explore alternatives

Understanding Foreclosure in Texas

Foreclosure in Texas happens when homeowners can't pay their mortgage. This process can be confusing and scary. Let's make it easier to understand.

What is Foreclosure?

Foreclosure is when a lender takes a property because the homeowner didn't pay their loan payments. In Texas, most home loans use a deed of trust. This allows for a quicker foreclosure process if payments are missed.

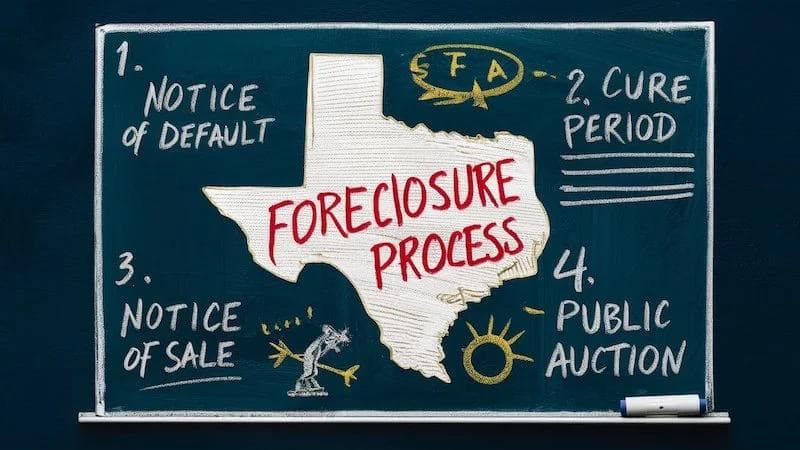

The Texas Foreclosure Process and Foreclosure Timeline

Texas has a non-judicial foreclosure process. This means the lender can foreclose on a Texas house without going to court.

In Texas, the foreclosure process has a clear timeline. Homeowners facing financial trouble should know these stages. This helps them make better decisions about their property.

The process starts when a homeowner misses a mortgage payment. After a grace period, the lender sends a notice of default. This marks the beginning of pre-foreclosure and the legal process.

This phase lets homeowners pay off the debt or look into other options.

If the debt isn't paid, the lender posts a notice of sale. This notice tells about the upcoming foreclosure auction. It usually happens on the first Tuesday of the month at the county courthouse.

- Missed payment

- You will receive a Notice of default

- Pre-foreclosure

- Notice of sale

- Foreclosure auction

- Eviction

The foreclosure auction is a key moment. If the property is sold, the new owner might start eviction. The whole process can take 6 months to a year, depending on several factors.

Remember, each stage of the foreclosure timeline offers chances for homeowners to act and maybe save their homes. You can still sell your Texas house fast and avoid foreclosure as long as it is before the auction.

Knowing this timeline helps homeowners act fast. They can look into loan modification, short sale, or selling the property before the auction.

Legal Implications for Homeowners

Foreclosure can have serious consequences. Homeowners may face eviction, damage to their credit score, and even owe money after the sale in the form of a judgement. It's crucial to understand your rights under Texas mortgage law. Exploring all options before foreclosure is key.

"Knowledge is power when facing foreclosure. Understanding the process can help homeowners make informed decisions about their property and future."

If you're struggling with mortgage payments, reach out to your lender early. Many are willing to work with homeowners to find solutions and avoid foreclosure.

Rights of Homeowners During Foreclosure

Texas homeowners facing foreclosure have legal protections. The State Bar of Texas provides resources on foreclosure laws. These resources help homeowners understand their rights. They include the chance to cure default and redeem property.

Legal Protections

Foreclosure laws in Texas give homeowners time to fix their financial issues. They have the right to receive notice before foreclosure starts. This notice period lets them look for options and get help.

Lender Communication

Talking with lenders is crucial during foreclosure. Homeowners can share their situation and look for solutions. Lenders might offer a loan modification or repayment plan. These options can help avoid foreclosure and keep homes.

Foreclosure Prevention Options

There are several ways to prevent foreclosure:

- Refinancing the mortgage

- Seeking forbearance

- Selling the property before auction

A loan modification can change loan terms to make payments easier. A repayment plan lets homeowners pay off missed payments over time. Both options require talking openly with lenders.

"Knowledge is power. Understanding your rights and options can make a big difference in foreclosure situations."

A last ditch method of avoiding damage to your credit is to request a deed in lieu of foreclosure. You will be giving the house to the lender and will not receive anything for your equity. This does however allow you to avoid foreclosure proceedings and selling the house.

Homeowners should act fast when facing foreclosure. Getting help early increases the chances of keeping a home or finding a good solution.

Can You Sell a House in Foreclosure Texas?

In Texas, you can sell a house in foreclosure. Homeowners facing foreclosure have options before the auction. A pre-foreclosure sale can help those struggling with mortgage payments. A traditional home sale isn't always possible due to time constraints.

To begin, homeowners must get a signed offer on their property. This offer should match the home's current market value. After getting an offer, it's important to tell the lender and bank about the sale.

Lenders often prefer this option as it helps recover the mortgage balance. They usually pause foreclosure if a valid offer is made. This gives homeowners a chance to sell and keep some equity. Most people do not know this is possible.

- Secure a signed offer before the auction date

- Inform your lender about the sale

- Aim for a sale price that covers the mortgage balance

Timing is key when selling a house in foreclosure. Starting a pre-foreclosure sale early gives you more time. This time is crucial for negotiating with buyers and getting lender approval.

"Selling during pre-foreclosure gives homeowners more control over the outcome and can help preserve their credit score." - Danny Johnson

If the purchase price is less than the mortgage balance and fees (missed mortgage payments, late fees, attorney fees, etc), lender approval is required for the sale to go through. This is because it will now be a short sale. The bank will be deciding if they are willing to accept less than what is owed. If approved, you can sell the property and avoid foreclosure's negative effects.

Benefits of Selling a House Before Losing It To Foreclosure

Selling a house in foreclosure can be a smart move for homeowners facing financial troubles. It offers several advantages that can protect your financial future and open new opportunities.

Protect Your Credit Score

Selling before foreclosure helps protect your credit report. A foreclosure can stay on your credit history for seven years. This makes it hard to get loans or rent apartments. By selling, you avoid this long-lasting negative mark on your credit score.

Avoid Deficiency Judgments

Selling your house can help you avoid a deficiency judgment. If your home sells for less than what you owe, the lender might pursue you for the difference. By selling proactively, you increase your chances of covering the full mortgage amount and avoiding this financial burden.

Faster Path to Future Home Purchase

Choosing to sell instead of going through foreclosure can speed up your ability to buy another property. Without a foreclosure on your record, you may qualify for a new mortgage sooner. This means you could be on the path to your future home purchase much faster than if you let the foreclosure process play out.

- Maintain better control over the sale process

- Potentially walk away with some equity

- Reduce stress and uncertainty associated with foreclosure

By choosing to sell the home, you take proactive steps to protect your financial health and keep your housing options open for the future.

Steps to Sell Your House During Foreclosure

Selling a house during foreclosure is tough, but it can be done right. Start by figuring out what your house is really worth. You can get this info from a property appraisal or talking to a real estate agent.

After knowing your home's value, set a selling price. This price should cover what you owe on the mortgage, interest, late fees, and other costs. Think about the current market and your financial situation when setting the price.

Tell your lender you plan to sell your house. This is important because it might lead to other options or more time. A skilled real estate agent can make selling faster. They can market your house well and talk to buyers for you.

- Determine fair market value

- Set an appropriate asking price

- Notify your lender

- Work with a real estate professional

- Market the property and negotiate offers

If you need to sell fast, think about a cash offer from a real estate investor. This can lead to a quicker sale, avoiding the foreclosure auction. We will discuss this in a later section. The aim is to sell before the auction to protect your credit and finances.

Challenges When Selling a House in Foreclosure

Selling a house in foreclosure has its own set of challenges. Homeowners face a tight timeline, uncertain markets, and complex relationships with lenders. Let's dive into these issues.

Time Constraints

The clock is always ticking when you're selling a foreclosed home. You need to sell before the auction date. This creates a rush that might lead to quick decisions, affecting the sale price.

Market Value vs. Mortgage Balance

There's often a gap between the home's market value and the mortgage balance. If the market drops, the home's value might be less than what you owe. This makes selling harder and might mean you need to do a short sale.

Dealing with Lenders

Talking to lenders can be tough. They might not agree to a sale price lower than the loan balance. You'll need to negotiate well to find a solution that works for everyone.

- Communicate with your lender often

- Property condition affects value and buyer interest

- Underwater mortgages limit profit potential

- Balancing lender demands with buyer offers is challenging

Overcoming these hurdles takes patience and sometimes expert advice. Knowing your options, like short sales or negotiating with lenders, helps you make smart choices during a stressful time.

Working with Real Estate Professionals

Selling a house in foreclosure can feel like a big task. A good real estate agent can make it easier and more successful. They know how to value your property and market it well.

Agents who have sold foreclosures before know the process well. They help you navigate through the tough parts, talk to lenders, and meet important deadlines. Their negotiation skills are key to getting a good deal for your property.

When picking a real estate agent, look for someone with:

- Experience in foreclosure sales

- Strong marketing strategy skills

- Proven negotiation abilities

- Knowledge of local market trends

Your agent will do a detailed property valuation. They'll consider your home's condition and the market. This helps set a price that draws buyers and gets you the most money.

"A professional real estate agent can be your greatest asset when selling a home in foreclosure. Their expertise can mean the difference between a quick sale and a prolonged process."

Time is crucial in foreclosure sales. An experienced agent can quickly find buyers with a good marketing plan. They use online platforms, social media, and their network to show your property well.

Working with a skilled real estate professional means more than just selling a house. It's about increasing your chances of a successful sale in a tough situation.

Sometimes there simply isn't enough time to find a buyer and close the transaction. In those cases, a cash home buyer is usually the best option.

Sell Fast to a Cash Home Buyer

Are you facing foreclosure in Texas? Selling to a cash home buyer, such as Danny Buys Houses in San Antonio, could be your solution. This method offers a fast closing, often in just a week. It's a great way to prevent foreclosure and move forward quickly. You can sell sooner rather than later.

Cash buyers buy houses as-is. So, you won't have to worry about expensive repairs or staging. This makes the process quick and saves you time and money.

- Receive a cash offer within 24-48 hours

- Close the deal in as little as 7 days

- Sell your home in its current condition

- Avoid realtor fees and closing costs

Choosing a cash sale can help you pay off your mortgage and avoid foreclosure's bad effects on your credit. It's a smart move that lets you take charge of your situation and start fresh.

"Selling to a cash buyer saved my credit and gave me a fresh start. I couldn't believe how quick and easy the process was!" - Janet M.

Time is critical when facing foreclosure. A cash offer could be the fast solution you need. Don't wait too long - consider this option to see if it's right for you.

Danny Buys Houses would love to make a cash offer on your house so you can avoid foreclosure. Just give us a call or fill out the fast cash offer form!

Alternative Options: Short Sales and Deed in Lieu

If you can't sell your house in foreclosure, think about a short sale or deed in lieu. These options can prevent foreclosure and its tough effects.

Understanding Short Sales

A short sale happens when your lender lets you sell for less than the mortgage balance. You need lender approval and it might lead to debt forgiveness. A short sale usually doesn't hurt your credit as much as foreclosure does.

Pros and Cons of Deed in Lieu

With a deed in lieu, you give your property to the lender to pay off your mortgage. It's quicker than foreclosure but might lead to tax issues. The lender must agree to this, and it could make it hard to buy another home later.

Comparing Alternatives

Think about these points when deciding:

- Credit impact: Both options usually don't hurt your credit as much as foreclosure does

- Time frame: Short sales take longer, but deed in lieu is quicker

- Tax consequences: If you get debt forgiveness, it could be seen as taxable income

- Future home purchases: These choices might affect your ability to get new mortgages

Talk to a financial advisor to see which option fits your situation best. Each choice has its own good and bad points. So, it's important to think carefully about your financial future.

Legal Considerations and Foreclosure Laws in Texas

The Texas Property Code sets the rules for foreclosure in Texas. It's key for homeowners facing foreclosure to know these laws. Texas has both judicial and non-judicial foreclosures, with non-judicial being faster.

Non-judicial foreclosure is often chosen by lenders in Texas. It doesn't need court action, making it quicker and cheaper. Lenders must follow certain steps in the Texas Property Code. This includes giving the homeowner proper notice and waiting a certain period before the sale.

In Texas, the right of redemption is different for tax and mortgage foreclosures. For tax foreclosures, it exists, but not for mortgage foreclosures. So, once a home is sold through foreclosure, the original owner usually can't get it back by paying off the debt.

- Lenders can pursue deficiency judgments in Texas

- Anti-deficiency laws may limit collection efforts

- Homeowners should know their rights and timelines

Deficiency judgments are allowed in Texas, but anti-deficiency laws can limit what lenders can collect. These laws help protect homeowners from too much debt after losing their homes. Homeowners need to understand notice rules and their rights during foreclosure to handle it well.

Yes, You Can Sell a House in Foreclosure in Texas

Facing foreclosure in Texas can be scary, but homeowners have ways to get help. Selling a house during foreclosure can lead to financial recovery. It also helps avoid credit damage and potential debt judgments, giving homeowners a new start.

Time and the market can make things tough, but experts or cash sales can make it easier. Homeowners should look into short sales and deed in lieu to find what works best for them. Knowing Texas foreclosure laws is crucial for making good decisions.

By carefully considering these options, homeowners can aim for stability and a better financial future. Remember, preventing foreclosure starts with action and seeking support. With the right steps, homeowners can get through this hard time and look forward with confidence.

Frequently Asked Questions

n this section we will answer the most common questions to sell a house in foreclosure in Texas

What is the process for selling a house in foreclosure in Texas?

In Texas, you can sell a house in foreclosure before the auction date. You must obtain approval from your lender if you owe more than the propertys value. The sale proceeds should cover the outstanding mortgage balance to avoid further legal action.

How does payment work when selling a foreclosed home in Texas?

Payment typically involves settling any outstanding mortgage debt first. If the sale price exceeds what you owe, you receive the remaining funds. If not, it might be necessary to negotiate with lenders for a short sale or pay any deficit.

Can foreclosure forgiveness impact my ability to sell my house in Texas?

Yes, if your lender offers foreclosure forgiveness (e.g., forgiving part of your debt), it could make selling easier by reducing what you owe, potentially avoiding a shortfall at closing.

Are there specific programs offering payment assistance or forgiveness when selling a foreclosed property in Texas?

Various federal and state programs might offer assistance or incentives for homeowners facing foreclosure. These can include payment plans or partial debt forgiveness under certain conditions—consulting with housing counselors could provide tailored assistance options.

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.