What Happens After You Sell - How Cash Buyers Use Your House

By Danny Johnson | Updated 9/9/2025, 3:50:49 PM

Curious what cash home buyers do with your hosue after they buy it? Find out here. You might be surprised.

- Fix and Flip or Long Term Rental

- What If They Find Something Wrong With The House?

- Will People Be Able to Know What I Sold the House For in Texas?

- Important Aspects of Selling to a Cash House Buyer

- Ideal Scenarios for Cash Sales

🗂 Table of Contents

When selling a home for cash, many homeowners focus on the speed and convenience. It's also good to know how the buyer plans to use the property. Different buyers have different plans, like renovating or reselling.

Fix and Flip or Long Term Rental

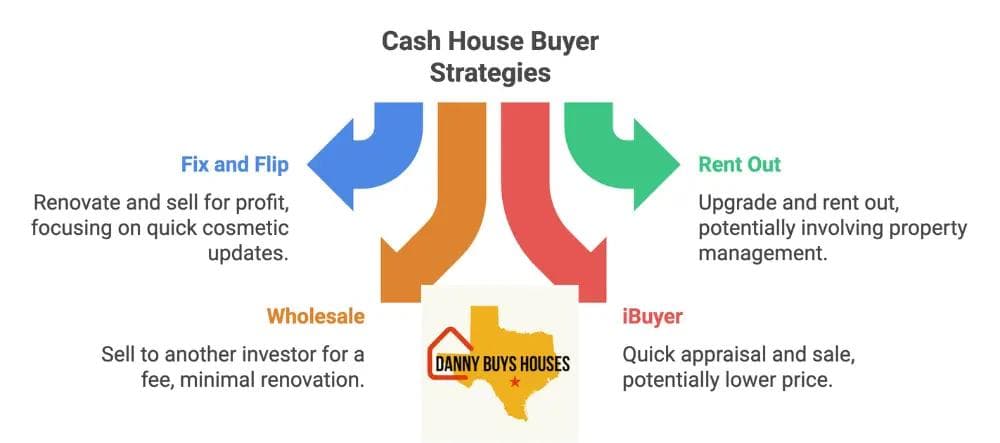

One common plan is the fix and flip model. The buyer buys the property to renovate and sell it for more. They look for homes that can be improved quickly. Cosmetic updates like new paint and flooring can greatly increase the home's value.

Another plan is to rent the home out. Cash buyers might be individual landlords or big investor groups. They upgrade the home and rent it out. As a seller, you won't be involved after the sale, but you might see property management companies soon.

Some buyers act as wholesalers. They buy your house and then sell it to another investor for a fee. This method involves little renovation. Instead, they focus on finding buyers for your home.

Homeowners might also deal with iBuyers. These companies use technology to quickly appraise and buy homes. They might do some repairs and then list the home again. This method is fast but might not get you the highest price.

What If They Find Something Wrong With The House?

After the as-is sale, the buyer is responsible for any changes. This saves you time and money. But, it's interesting to see how the house might change under new ownership.

The buyer's plan affects the offer you get. A buyer planning to flip the house might offer less. A buyer looking to rent it out might offer more. Knowing this helps you understand if the offer meets your needs.

After the sale, you usually don't have to deal with the property anymore. Knowing what happens next helps you feel sure about your decision. You might want to see the changes or not. Either way, understanding how buyers use the properties they buy helps clarify their motivations.

Will People Be Able to Know What I Sold the House For in Texas?

In Texas, amounts houses sell for is not disclosed. People will not be able to find what a cash buyer paid for your house. If the buyer got a loan, that loan amount may be of public record however. The loan amount is not always the sales price, so the general public will still not know what was actually paid.

Important Aspects of Selling to a Cash House Buyer

Rapid Timeline and Simplicity: The cash buying process eliminates many of the delays and complications found in conventional home sales. Without waiting for mortgage approvals or dealing with financing contingencies, transactions can close in as little as 7-14 days. This streamlined approach removes the uncertainty and stress that often accompanies traditional sales methods.

Sell in Current Condition: One of the most appealing aspects is the ability to sell your property exactly as it stands today. There's no need to invest time or money in repairs, renovations, or expensive staging. Whether your home needs minor touch-ups or major structural work, cash buyers purchase properties in their existing state.

Guaranteed Funding: Cash transactions eliminate the risk of deals falling through due to financing issues. Since investors pay with readily available funds rather than borrowed money, there's no concern about loan denials or appraisal problems that commonly derail traditional sales.

Trade-off Considerations: The convenience and speed of cash sales come with a financial trade-off. Investors typically offer 70-80% of a home's after-repair value, which accounts for renovation costs and business profit margins. While this means less money upfront, it often results in similar net proceeds when you factor in avoided repair costs, realtor commissions, and carrying costs.

Transparent Pricing: Reputable cash buyers don't charge hidden fees, commissions, or closing costs to sellers. The offer you receive is typically what you'll walk away with at closing.

Ideal Scenarios for Cash Sales

Time-Sensitive Situations: If you're facing foreclosure proceedings, job relocation deadlines, or divorce settlements that require quick property division, the speed of cash transactions can be invaluable. Traditional sales that take 60-90 days simply aren't feasible in these urgent situations

Property Condition Challenges: Homes requiring extensive repairs, outdated systems, or structural improvements are perfect candidates for cash sales. Rather than investing thousands in renovations with uncertain returns, you can sell immediately and avoid the hassle entirely.

Lifestyle Preferences: Some homeowners simply want to avoid the disruption of showings, open houses, and the back-and-forth negotiations typical of traditional sales. Cash buyers offer a private, straightforward transaction that respects your time and privacy.

Financial Relief: Whether you're dealing with inherited property you don't want to maintain, rental properties that have become burdensome, or simply want to liquidate real estate assets quickly, cash sales provide immediate financial resolution.

The key is understanding your priorities: if maximizing every dollar is your primary concern, traditional sales might be better. However, if convenience, speed, and certainty are more valuable to your situation, cash buying could be the perfect solution.

Frequently Asked Questions

In this section we will answer the most common questions to what real estate investors do with houses

What is the primary strategy real estate investors use when buying houses with cash?

Real estate investors often buy houses with cash to quickly close deals, avoid mortgage-related costs and complications, negotiate better prices, and potentially renovate or flip the property for a profit.

How do real estate investors determine the potential value of a house before purchasing it with cash?

Investors typically conduct a comparative market analysis (CMA), assess local market trends, evaluate the condition of the property, and estimate renovation costs to determine potential value and profitability.

Why do some real estate investors prefer using cash over financing when acquiring properties?

Using cash allows investors to eliminate interest payments, reduce closing time and costs, increase negotiation leverage with sellers, and enhance competitiveness in bidding situations.

What are common exit strategies for real estate investors after purchasing a house with cash?

Common exit strategies include selling the renovated property at a higher price (flipping), renting it out for passive income, or holding onto it long-term for appreciation.

How do tax benefits influence real estate investment decisions involving houses purchased with cash?

Investors can benefit from tax deductions on expenses such as repairs and depreciation. However, paying in cash may limit mortgage interest deductions but simplifies financial management.

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.