How Cash Buyers Determine Their Offers and What That Means for You

By Danny Johnson | Updated 9/2/2025, 4:47:22 PM

Learn how cash house buying companies determine how much they will offer for your home.

- How Cash House Buyers Set Their Price

- The 70% Rule: The Foundation of Cash Offers

- 1. ARV (After-Repair Value)

- 2. Repair Costs

- 3. Investor's Margin

- The 70% Rule in Practice

- How Repair Costs Affect Price

- Major Repairs (High Impact on Offer)

- Moderate Repairs (Medium Impact)

- Cosmetic Repairs (Lower Impact)

- Factors That Influence the Offer Amount

- Local Market Conditions

- Property-Specific Factors

- Investor's Business Model and Risk Tolerance

- Different Types of Cash Buyers and Their Approaches

- Fix-and-Flip Investors

- iBuyers (Instant Buyers)

- Buy-and-Hold Investors

- Wholesalers

- Final Considerations When Finding Out How Much Investors Will Pay For Your House

🗂 Table of Contents

How Cash House Buyers Set Their Price

When selling your home to a cash buyer, you might wonder how they set their price. Unlike traditional buyers, cash buyers have their own way of figuring out the price. Knowing how they do this can help you feel more confident and make a better decision.

How much will an investor pay for my house? This is a common question we hear from sellers wanting to sell their house for cash.

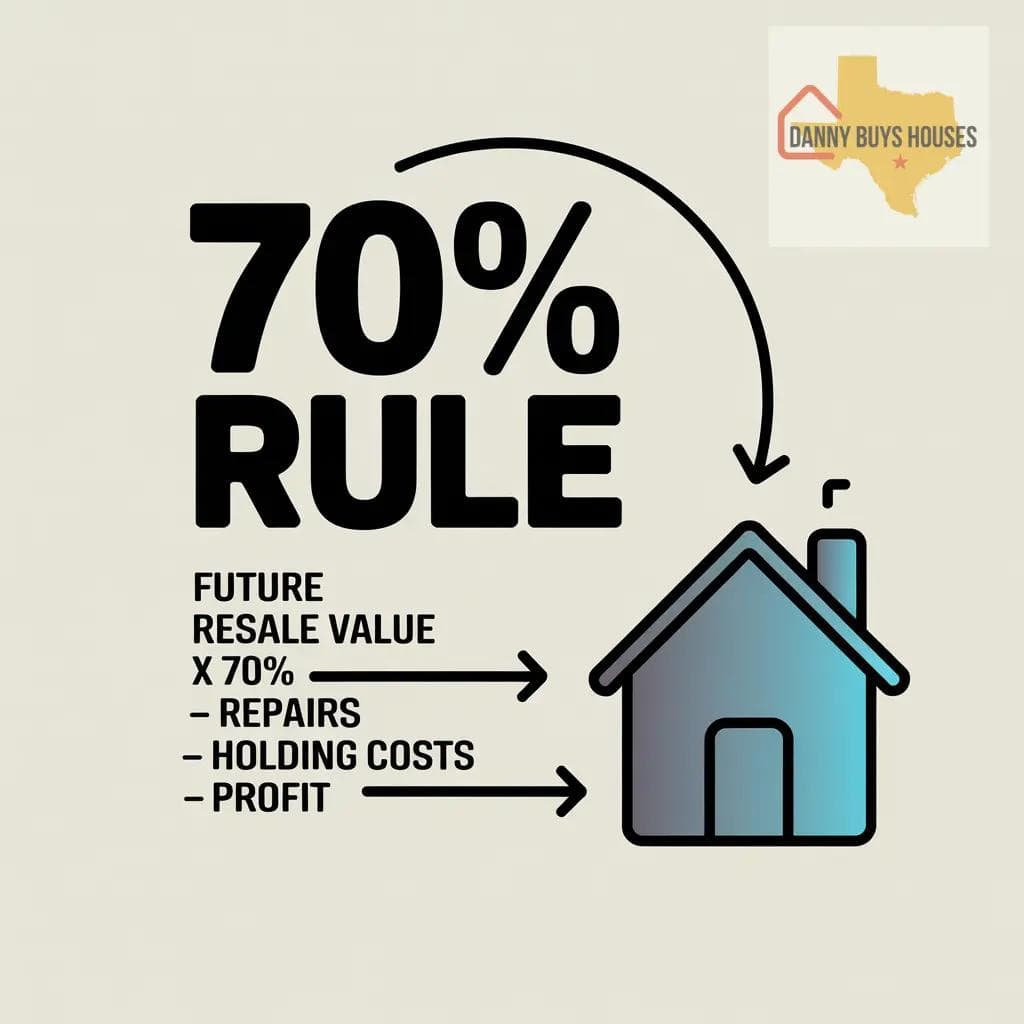

The short answer is that it depends on what type of investor it is. An investor using the typical 70% rule would offer approximately 70% of your home's future resale value (ARV), less the cost of repairs, their holding costs, and some profit of course. There are iBuyers that might pay more but usually charge a fee.

Let's dig into this so that you know what to expect as you head out there to get a cash offer.

The 70% Rule: The Foundation of Cash Offers

The most common formula used by cash home buyers is the 70% Rule, which serves as the industry standard for quick property valuations and investment decisions.

Formula: (ARV × 0.70) – Repair Costs = Maximum Offer Price

This rule breaks down into three essential components:

1. ARV (After-Repair Value)

The ARV represents the estimated market value of your home after all necessary renovations and repairs are completed. Cash buyers determine this by:

- Analyzing recent comparable sales (comps) in your neighborhood

- Considering current market trends and demand

- Evaluating the property's potential once fully renovated

- Factoring in location desirability and local market conditions

2. Repair Costs

The condition of your property is a big factor. Cash buyers look for homes that need work, adding the cost of repairs to their offer. These costs include:

- Structural repairs (foundation, roofing, electrical, plumbing)

- Cosmetic updates (flooring, paint, fixtures, appliances)

- Code compliance and permit requirements

- Landscaping and exterior improvements

- Unexpected repairs that commonly arise during renovation

3. Investor's Margin

The remaining 30% in the 70% rule accounts for:

- Profit margin: The investor's desired return on investment

- Holding costs: Expenses incurred while owning and renovating the property, including:

- Property taxes and insurance

- Utilities during renovation

- Storage and security costs

- Interest on borrowed renovation funds

- Risk buffer: Protection against cost overruns, market fluctuations, and unexpected issues

The 70% Rule in Practice

Example: If your home's ARV is $300,000 and it needs $30,000 in repairs, an investor might offer around $180,000 ($300,000 × 0.70 – $30,000).

Let's break this down:

- ARV: $300,000

- 70% of ARV: $210,000

- Minus repair costs: $210,000 – $30,000 = $180,000

- Final offer: $180,000

This leaves the investor with $90,000 (30% of ARV) to cover their profit, holding costs, transaction expenses, and risk management.

Danny Buys Houses is a transparent cash house buying company in San Antonio. We share our exact process for determining how much we can offer you for your house.

How Repair Costs Affect Price

The condition of your property is a big factor. Cash buyers look for homes that need work, adding the cost of repairs to their offer. This means they might offer less than a buyer who wants a home ready to move into. But, you won't have to fix the house yourself.

The extent and type of repairs needed significantly impact the final offer:

Major Repairs (High Impact on Offer)

- Foundation issues

- Roof replacement

- Electrical system upgrades

- Plumbing overhauls

- HVAC system replacement

- Structural damage

Moderate Repairs (Medium Impact)

- Kitchen and bathroom updates

- Flooring replacement

- Windows and doors

- Exterior siding or painting

- Driveway and walkway repairs

Cosmetic Repairs (Lower Impact)

- Interior painting

- Light fixtures and hardware

- Minor appliance repairs

- Landscaping improvements

- Cleaning and staging

Market analysis is also important. Cash buyers look at what similar homes have sold for to figure out your home's value. They consider trends and demand in the area. If your home is in a hot market, you might get a better offer.

Buyers who plan to flip houses focus on the after-repair value (ARV). They subtract costs and their profit margin from the ARV to get their offer. If their offer seems low, it might be because they see expensive repairs ahead.

Some buyers want to rent out the house. They look at rental income and maintenance costs. This can lead to a slightly higher offer, but it's still based on their cash flow. This approach can make their offer feel fair but still based on solid numbers.

At times, a cash buyer might be a wholesaler. Wholesalers sell the right to buy the house to another investor. Their offer might be lower because they make their profit from the difference. This can be good if you need to sell quickly, but make sure the buyer can close the deal.

Factors That Influence the Offer Amount

Local Market Conditions

Market analysis is also important. Cash buyers look at what similar homes have sold for to figure out your home's value. They consider trends and demand in the area. If your home is in a hot market, you might get a better offer.

Market factors include:

- Supply and demand: High demand markets may yield higher offers

- Days on market: How quickly homes sell in your area

- Price trends: Whether values are rising, stable, or declining

- Seasonal factors: Time of year affecting buyer activity

- Economic conditions: Local employment, interest rates, and economic health

Property-Specific Factors

- Location desirability: School districts, amenities, neighborhood quality

- Lot size and usable space: Expansion potential and outdoor space

- Architectural style: Market appeal of the home's design

- Age and condition: Overall maintenance and updating needs

- Unique features: Special characteristics that add or detract from value

Investor's Business Model and Risk Tolerance

Each investor operates differently based on:

- Experience level: New vs. seasoned investors

- Available capital: Cash reserves and financing capacity

- Timeline requirements: How quickly they need to complete projects

- Profit expectations: Target returns and risk tolerance

- Market specialization: Types of properties and neighborhoods they prefer

Most cash buyers will explain how they came up with their offer. You can ask about repair costs, market trends, and profit margins. Even if you don't get all the details, understanding the basics can help you decide if the offer is fair. If the buyer is secretive, think twice about moving forward.

Cash buyers see risk differently than traditional buyers. They offer speed and certainty, which can be great if you need to sell fast. But, you might get a lower price. Knowing how they calculate their offers helps you compare and make a choice that's right for you.

Being open with a potential buyer is good for both sides. They can close quickly, and you avoid financing delays. Whether to accept the offer depends on your priorities. Do you value a quick sale or a higher price through traditional means? Understanding cash offers helps you negotiate better and make a choice that fits your needs.

Different Types of Cash Buyers and Their Approaches

Fix-and-Flip Investors

Buyers who plan to flip houses focus on the after-repair value (ARV). They subtract costs and their profit margin from the ARV to get their offer. These investors:

- Stick closely to the 70% rule

- Focus heavily on renovation potential

- Prioritize properties in desirable neighborhoods

- Typically offer 65-75% of ARV minus repairs

iBuyers (Instant Buyers)

Type of Investor: iBuyers tend to offer closer to market value than traditional "We Buy Houses" companies. These tech-enabled companies:

- Use automated valuation models

- Offer 80-95% of market value

- Charge service fees (typically 5-7%)

- Focus on homes in good condition

- Provide the fastest closing times

Buy-and-Hold Investors

Some buyers want to rent out the house. They look at rental income and maintenance costs. This can lead to a slightly higher offer, but it's still based on their cash flow. These investors consider:

- Rental income potential

- Cash-on-cash return calculations

- Long-term appreciation prospects

- Property management requirements

- May offer 70-80% of market value

Wholesalers

At times, a cash buyer might be a wholesaler. Wholesalers sell the right to buy the house to another investor. Their offer might be lower because they make their profit from the difference. Characteristics include:

- Typically offer 60-70% of ARV

- Quick closing capabilities

- Assign contracts to other investors

- Lower offers due to additional profit layer

Final Considerations When Finding Out How Much Investors Will Pay For Your House

Whether to accept the offer depends on your priorities. Do you value a quick sale or a higher price through traditional means? Understanding cash offers helps you negotiate better and make a choice that fits your needs.

The decision ultimately comes down to your specific circumstances, financial needs, timeline requirements, and risk tolerance. By understanding how cash buyers calculate their offers using formulas like the 70% rule, you can evaluate whether their proposal aligns with your goals and negotiate from a position of knowledge and confidence.

Remember that the best offer isn't always the highest offer—it's the one that best meets your needs while providing fair value for your property in its current condition.

Frequently Asked Questions

In this section we will answer the most common questions to how much cash house buying companies pay for houses

How do cash house buying companies determine the price they offer for a property?

Cash house buying companies typically assess the propertys current market value, condition, location, and potential repair costs to determine their offer, usually below market value to account for quick sale benefits.

What percentage of market value do cash house buyers generally offer?

Cash buyers often offer between 70% and 85% of the homes market value to ensure a margin for resale or investment purposes.

Are there any fees involved when selling a house to a cash buyer company?

Generally, reputable cash buying companies cover closing costs and charge no additional fees, but its important to confirm this upfront with the specific company.

How quickly can sellers expect to receive payment from cash house buying companies?

Sellers can usually receive payment within 7-14 days after accepting an offer, as these transactions are expedited without mortgage approval delays.

What advantages do sellers have by choosing a cash buyer over traditional real estate sales?

Selling to a cash buyer offers advantages like faster closing times, no need for repairs or staging, fewer sales falling through due to financing issues, and reduced stress.

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.