How Many Months Behind on Your Mortgage Before Foreclosure? Don't Lose Your House!

By Danny Johnson | Updated 9/27/2024, 1:37:33 PM

Worried about missing mortgage payments? Learn how many months you can fall behind before foreclosure begins.

- Key Takeaways

- Understanding the Mortgage Delinquency Timeline

- Grace Period and Late Fees

- The 30-Day Mark: Credit Reporting Begins

- 60 Days Past Due: Escalating Consequences

- 90 Days Late: The Notice of Default

- How Many Months Behind on Mortgage Before Foreclosure?

- The 120-Day Rule: When Foreclosure Typically Starts

- Factors Affecting Foreclosure Timelines

- State-Specific Foreclosure Laws

- Strategies to Avoid Foreclosure When Behind on Payments

- Communicate Early with Your Lender

- Exploring Loan Modification Options

- Considering Forbearance Agreements

- Sell to a Cash House Buyer

- Now You Know How Many Months Behind on Your Mortgage Until Foreclosure

🗂 Table of Contents

The fear grips you like a vice. Another month, another missed mortgage payment. How many can you miss before foreclosure? Scary thought.

You're not alone. Countless homeowners face this nightmare, wondering how long before they lose everything.

It's a terrifying journey, but knowledge is power.

Let's unravel the mortgage delinquency timeline together and explore your options to keep your home.

Your home is more than just walls and a roof. It's where memories are made, where your kids took their first steps, where you've laughed, cried, and dreamed. The thought of losing it to foreclosure is gut-wrenching.

But don't panic.

Understanding the process and knowing your rights can be your lifeline.

If you miss a mortgage payment, it's not yet a huge deal.

Typically, lenders start the pre-foreclosure process after 90 days of missed payments.

That's three months of sleepless nights, wondering what comes next after each passing due date.

By the fourth missed payment, or 120 days after your first default, foreclosure proceedings begin. It's a ticking clock, but it's not the end of the road.

Your credit score takes a hit with each late payment, starting from just 30 days past due. It's like a domino effect, impacting your financial future with each monthly mortgage payment that is missed.

Most people walk away from foreclosure with no money from the auctioning of their home.

But here's the silver lining: you have options. From loan modifications to forbearance agreements, there are ways to navigate this storm. Let's explore how to keep your property and your peace of mind.

We will also cover what to do if you are near the end of the road and facing foreclosure auction. It is possible to get cash for your house before the foreclosure sale. We will show you how.

Key Takeaways

- Foreclosure typically starts after 3-4 months of missed monthly payments

- Credit scores begin to suffer after 30 days after you miss a payment

- Lenders usually offer a 15-day grace period for payments

- Foreclosure impacts credit reports for seven years

- Options like loan modification and forbearance can help avoid foreclosure

- Early communication with lenders is crucial before they foreclose

- Seeking professional help can provide more options to save your home

Understanding the Mortgage Delinquency Timeline

Falling behind on mortgage payments can be stressful. Knowing the delinquency timeline helps homeowners understand what to expect and take action.

Let's break down the key stages of mortgage delinquency.

Grace Period and Late Fees

Most mortgage servicers offer a 15-day grace period for payments. After this time, late fees kick in. These fees typically range from 3% to 6% of the overdue amount.

It can be hard to pay your mortgage on time because of issues outside your control. That is why they provide this grace period.

It's crucial to make payments within this window to avoid extra costs and maintain a good credit score.

The 30-Day Mark: Credit Reporting Begins

This is your first missed payment. If a payment is 30 days late, the loan servicer or mortgage lender reports the delinquency to credit bureaus. This can significantly impact your credit score. Late payments stay on credit reports for up to seven years, affecting future borrowing opportunities.

60 Days Past Due: Escalating Consequences

At 60 days, the situation becomes more serious. The loan servicer may start calling more frequently. Your credit score will likely drop further. Some lenders might begin considering foreclosure options at this point.

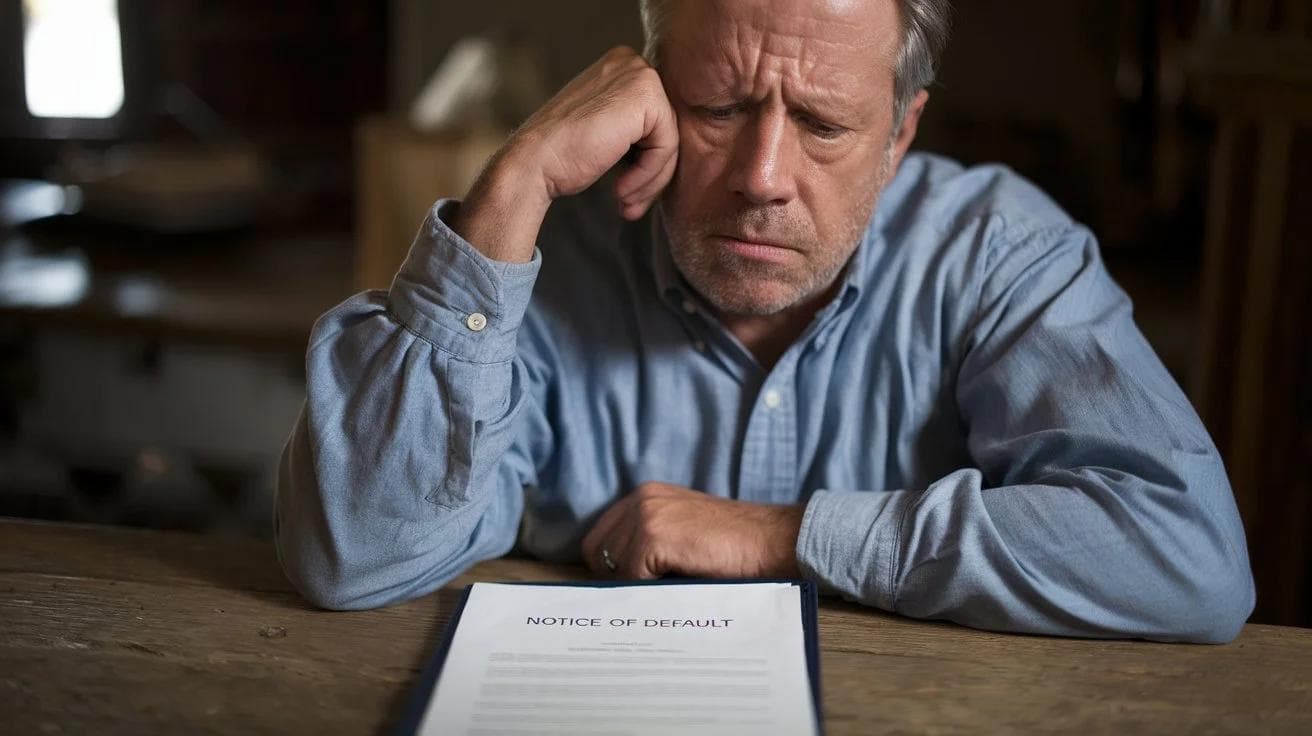

90 Days Late: The Notice of Default

After 90 days of missed payments, most lenders issue a notice of default.

This formal document states the loan terms have been broken. It's a critical moment in the delinquency timeline. The loan servicer must contact the borrower to discuss options for avoiding foreclosure.

According to BankRate, "Once the account is more than 120 days past-due, the servicer files a notice of default with a state court or local recorder’s office (depending on whether the foreclosure is judicial or nonjudicial). The borrower is notified of this filing via certified or first-class mail."

Remember, communication is key. If you're struggling with payments, reach out to your mortgage servicer early. They may offer solutions like loan modifications or forbearance agreements to help you avoid foreclosure and protect your home.

How Many Months Behind on Mortgage Before Foreclosure?

The foreclosure process is complex and varies by several factors. It's important for homeowners facing financial trouble to understand the timeline and key milestones because it's less scary when they know what to expect.

The 120-Day Rule: When Foreclosure Typically Starts

The 120-day rule is a key point in foreclosure. This is when you miss four consecutive mortgage payments.

Lenders start foreclosure after a borrower misses four payments. This 120-day period is why it is called the 120-day rule.

During this time, homeowners get notices and warnings from their lender. It's crucial to respond quickly and look for ways to avoid foreclosure.

You should receive what your current balance due is so that you can cure the delinquency. This total will include the late payments, fees, and attorney's costs that many lenders will charge.

Factors Affecting Foreclosure Timelines

Several factors can change how fast a foreclosure happens:

- Lender policies

- State laws

- Housing market conditions

- Type of foreclosure (judicial or non-judicial)

In judicial foreclosures, the process involves court and takes longer. Non-judicial foreclosures, found in states like California and Texas, are often faster.

State-Specific Foreclosure Laws

Foreclosure laws differ by state. Some states let homeowners reclaim their property after foreclosure. Others have specific rules for lis pendens filings or other legal steps.

"Understanding your state's foreclosure laws is crucial for navigating the process effectively."

Texas does not allow homeowners to reclaim their home after foreclosure.

The housing market also affects foreclosure timelines. In a weak market, lenders might work with homeowners more. In a strong market, they might act faster to take back the property.

Strategies to Avoid Foreclosure When Behind on Payments

Falling behind on mortgage payments can be scary, but there are ways to avoid foreclosure. Let's explore some effective strategies to keep your home.

Communicate Early with Your Lender

Don't ignore letters from your lender. Open all mail and reach out as soon as you face financial trouble. Lenders often work with borrowers to find solutions.

Exploring Loan Modification Options

A loan modification can help make your mortgage more manageable. This might involve extending the loan term, lowering the interest rate, or adjusting the payment structure.

Considering Forbearance Agreements

Forbearance offers temporary relief by pausing or reducing payments. This can be a lifeline if you're facing short-term financial hardship. Remember, you'll need to repay the missed amounts later.

Once you contact your loan servicer and explain your situation, ConsumerFinance.gov says, "Here is one way to start the conversation: 'This is a big decision and I want to get it right. Can you tell me what options I have to stay in my home?” Or, if your situation is different, “Can you tell me what options I have, if I am ready to leave my home?'"

Sell to a Cash House Buyer

If keeping your home isn't feasible, selling to a cash buyer can be a quick solution. This option often works faster than a traditional home sale, helping you avoid foreclosure.

- Short sale: Sell your home for less than you owe, with lender approval

- Deed in lieu of foreclosure: Transfer ownership to the lender

- Cash for keys: Some lenders offer money to move out quickly

Selling the home to a house buying company can be a great alternative to foreclosure. This can help you limit the damage to your credit and get some of the equity out of the house.

For expert guidance, contact a HUD housing counselor at (800) 569-4287. They can help you understand your options and avoid scams. Remember, act early to increase your chances of a favorable outcome.

Now You Know How Many Months Behind on Your Mortgage Until Foreclosure

Facing mortgage challenges can be tough, but knowing your options is key. Most lenders give you a 15-day grace period before penalties start. This gives you a bit of time.

After 30 days, missing payments can hurt your credit score. By 90 days, you'll get a Notice of Default. This is a big step.

The 120-day mark is when foreclosure starts, as the law says. This time can change based on where you live and your lender's rules. In some cases, you have 20-30 days to answer a lawsuit. In others, it's faster.

Starting early and talking to your lender is the first step in preventing foreclosure. Looking into mortgage help like loan mods or forbearance can also help. Don't wait until you're four months behind.

Making tough decisions and taking action can help you avoid the awkwardness of being kicked out of your home after foreclosure.

There are ways to handle financial troubles, from credit issues to finding other foreclosure options. Being proactive and informed helps protect your home. Remember, foreclosure is a last choice for lenders, and they often want to help homeowners find solutions.

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.