The Texas Foreclosure Process Timeline: How Long Until You Lose Your Home?

By Danny Johnson | Updated 9/27/2024, 2:06:06 PM

Discover the Texas foreclosure process timeline and see how long it takes to lose your home. Understand Texas state law and explore ways to prevent foreclosure.

- Key Takeaways

- The Texas Foreclosure Process Timeline

- How long do I have if my house is in foreclosure?

- Will the lender start the foreclosure process after one missed payment?

- How long do you have to move out after foreclosure in Texas?

- Consider Your Options To Avoid Losing Your Home

- Catch Up Your Payments

- File Bankruptcy

- Sell To a Cash House Buyer

🗂 Table of Contents

The feeling of receiving a foreclosure warning is devastating. Your heart drops. The fear comes over you. Most of this fear is not knowing what is going to happen next.

This is a harsh reality for many Texans facing financial troubles as recent inflation since COVID-19 has made everything so darn expensive. The clock starts, and your home, once a safe place, is now at risk.

In Texas, the foreclosure process is fast. It's much quicker than the national average of 477 days. Here, it can take as little as 159 days from missing a payment to possibly losing your home. This is a harsh reminder to act fast.

If you are facing the foreclosure auction within a couple weeks, you might want to sell fast to a cash buyer. Sell your house for cash in San Antonio, Texas by contacting Danny Buys Houses. We are here to help.

We're going to look at the steps in the foreclosure timeline in Texas and what options you have along the way. It starts after 120 days of missed payments. The process then moves quickly. Non-judicial foreclosures, common in Texas, can finish in just two to three months from the notice to the auction where they will sell the property.

For homeowners facing foreclosure, knowing your options is crucial. Understanding Texas state law the foreclosure timeline, and available choices can help you keep your home. For some homeowners in Texas, the best option might be to look at alternatives to Foreclosure, like selling the home. Let's explore the Texas foreclosure process and how to navigate it.

Key Takeaways

- Texas has the fastest foreclosure process in the US, averaging 159 days

- The foreclosure timeline typically starts after 120 days of missed payments

- Non-judicial foreclosures in Texas can be completed in 2-3 months

- Notice of Default (NOD) is usually sent after 90 days of missed payments

- Homeowners have options to avoid or delay foreclosure if they act quickly

The Texas Foreclosure Process Timeline

We are known for how fast it can take in Texas to foreclose. It has the quickest average foreclosure timeline in the country, taking just 159 days.

Most foreclosures in Texas are non-judicial, meaning they don't go to court. This makes the process quicker than judicial foreclosures. It can finish in two to three months after it starts.

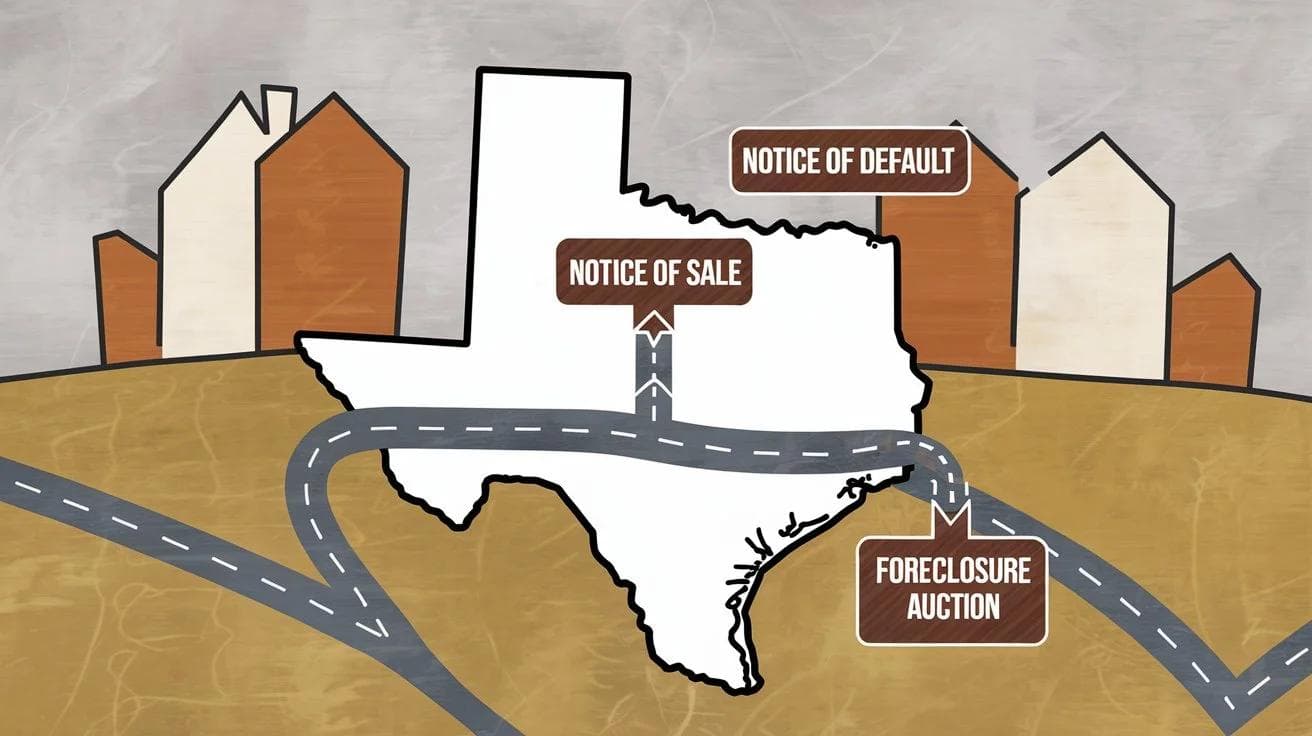

Here's a breakdown of how the process works for a typical non-judicial foreclosure timeline in Texas:

- Notice of default: This is where the process begins. The lender sends a notice of default via certified mail, giving the borrower 20 days to cure the default.

- Notice of sale: If the default isn't cured, the lender sends this notice at least 21 days before the foreclosure auction.

- Foreclosure sale: Occurs on the first Tuesday of the month between 10 a.m. and 4 p.m. at the county courthouse. This is where foreclosed houses sell at auction.

The deed of trust is the document in Texas foreclosures that has a power of sale clause. This clause lets lenders do a non-judicial foreclosure. This is why Texas foreclosures are so quick.

Texas law provides strong homestead protection, but there's no guaranteed right to undo a foreclosure after it's completed.

According to William R. Simon Jr., Esq., at Sollertis, "Texas law prevents most types of debts from forcing the sale of a homestead property as a means to satisfy those obligations. This safeguard allows homeowners to protect their primary residence during bankruptcy proceedings or other financial difficulties.

While the Texas Homestead Exemption provides significant protection, it’s important to be aware of the limitations and exceptions. Certain debts, such as mortgages, property taxes, and mechanic’s liens, can still lead to foreclosure or forced sale of the property. Additionally, the exemption has certain acreage limitations in rural areas, with limitations being different for property situated in urban areas."

If you're facing foreclosure, act quickly. Look into loan modifications or short sales as alternatives to losing your home. You might even consider trying to sell the house to a cash home buyer. This will allow you to sell quickly to help you avoid foreclosure. Remember, the clock starts ticking with the first missed payment. So, don't wait to find solutions.

How long do I have if my house is in foreclosure?

Homeowners often worry about how much time they have left when facing foreclosure. The grace period for missed payments is usually 10-15 days. After that, late fees start, and the lender might send a breach letter.

If you miss a payment for 30 days, you're in default. At this point, the lender might send a demand letter. The foreclosure timeline in Texas can vary from 30 to 120 days, depending on several factors.

Once the foreclosure process starts, you usually have at least 41 days before the sale:

- 20 days to cure the default after receiving the Notice of Default

- 21-day notice period before the sale

During this time, look into loss mitigation options. You might qualify for a loan modification or other alternatives to save your home. Remember, lenders often wait 90-120 days of delinquency before starting foreclosure proceedings.

According to Jim Akin at Experian, "The goal of mortgage modification is to avoid foreclosure, sparing the lender the hassle and expense of seizing and reselling your house and allowing you to keep the home. A mortgage modification will lower monthly payments, but will also likely mean greater total costs to you over the lifetime of the loan."

After the foreclosure sale, you'll usually have 3 to 30 days to vacate after receiving an eviction notice.

Will the lender start the foreclosure process after one missed payment?

Missing one mortgage payment won't start the foreclosure process. Lenders know that money troubles can happen. Most mortgage deals have a 10-15 day grace period for payments without extra fees. Even after this, foreclosure is not a quick step.

Your mortgage servicer usually waits until you're 30 days late to report missed payments. If you're 36 days past due, they'll call to talk about ways to avoid foreclosure. Late fees will add up, but foreclosure is still far off.

The 120-day rule is key in the foreclosure timeline. Federal law says foreclosure can start only after 120 days of missed payments. This time lets homeowners look for other options with their mortgage servicer.

- Day 1-30: Grace period, late fees may apply

- Day 31-36: Missed payment reported to credit bureaus

- Day 36-90: Lender contacts borrower, discusses options

- Day 90-120: Demand letter may be sent

- Day 120+: Foreclosure process can legally begin

If you're having trouble with payments, don't ignore calls from your mortgage servicer. They want to find other ways to help, like loan changes or temporary payment stops. Remember, foreclosure is a last choice for lenders. Talking openly can help you stop the foreclosure and keep your home.

How long do you have to move out after foreclosure in Texas?

After a foreclosure sale in Texas, the clock starts ticking for former homeowners. The new owner gains property possession and can start eviction proceedings right away. Unlike some states, Texas doesn't offer a post-foreclosure right of redemption. This means once the foreclosure sale happens, there's no guaranteed chance to reclaim your home. Texas homeowners cannot get their house back after the fact.

The eviction process typically takes 3 to 4 weeks, but timelines can vary. New owners must give a notice to vacate, which can range from 3 to 30 days. If you don't leave voluntarily, the new owner can file an eviction lawsuit. This involves:

- Filing the lawsuit

- Responding to allegations

- Attending a court hearing

- Receiving a possession judgment

- Potential physical removal by law enforcement

It's crucial to prepare for relocation before the foreclosure sale completes. Remember, specific eviction procedures can differ by county and circumstances. If you're facing foreclosure, consider exploring options to avoid losing your home before the sale occurs.

Consider Your Options To Avoid Losing Your Home

Facing foreclosure in Texas can be scary, but you have choices to save your home. Now that you know how the Texas foreclosure process works, let's look at your options to save your house and avoid foreclosure or sell your house.

Catch Up Your Payments

One great way to stop foreclosure is to catch up on payments. In Texas, you have up to 20 days after getting the Notice of Default to pay what you owe. This can reinstate your loan. You might also consider a loan modification or forbearance to make payments easier.

Most lenders give you a grace period of 10 to 15 days before they charge you late fees.

File Bankruptcy

Filing for bankruptcy can delay or stop foreclosure. Chapter 13 bankruptcy lets you restructure your debt and repay it over 3 to 5 years. This can help you stay in your home.

According to Chance M. McGhee, Attorney at Law, "While bankruptcy can postpone foreclosure, it has serious credit consequences that linger. Your credit score can drop 200+ points. And the foreclosure will still damage your credit once the bankruptcy concludes."

If you're okay with giving up your property, Chapter 7 bankruptcy can discharge most debts. It also protects you from being sued for any remaining loan balance after foreclosure.

Sell To a Cash House Buyer

If you need a quick solution, selling to a cash house buyer might be the way to go. You now know that once the foreclosure process begins, you don't have much time. This option lets you avoid foreclosure and might even give you some cash. Other alternatives include negotiating a short sale with your lender or seeking a deed in lieu of foreclosure.

You can sell your house during the foreclosure process. Selling to a cash house buying company can allow you to close and payoff the mortgage, late fees, attorneys fees, and call off the foreclosure.

If you would like to see how much you can get for your house in San Antonio, TX or surrounding areas, give Danny Buys Houses a call. We would love to help you through this difficult time.

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.