Probate in Real Estate Explained: What You Need to Know Before You Sell in Texas!

By Danny Johnson | Updated 9/3/2024, 8:16:34 AM

Discover the essentials of probate in real estate in Texas! Learn about probate sales, the legal process, and how to sell a deceased owner's property.

- Key Takeaways

- What is probate in real estate?

- Definition and purpose of probate in real estate

- What happens when someone dies without a will?

- What is considered real property in probate?

- Importance of clear title and heirship determination

- The Probate Process: From Filing to Distribution

- How to avoid probate in Texas?

- Selling a House During Probate in Texas

- Legal Requirements for Selling Probate Property

- Steps to List and Market a Probate Property

- The Role of the Court in Approving the Sale

- Navigating Challenges in Probate Real Estate Sales

- How long does an executor have to settle an estate in Texas?

- Conclusion

🗂 Table of Contents

Losing a loved one is hard. The grief can be overwhelming, and then comes the added stress of dealing with their estate. If you're facing the prospect of selling inherited property in Texas, you're not alone. Many families find themselves lost and overwhelmed in the complex world of probate real estate.

Max W. recalls, "I remember when my grandmother passed away. Our family was thrust into the unfamiliar territory of probate and estate law. We had many questions about inheritance and property sale. We wondered if all probate sales were cash only. It was a tough time, but we learned a lot about the probate process in Texas."

We hope to do the same for you if you are wondering what exactly probate in real estate is.

Whether you're an executor, an heir, or just curious about probate in real estate, this guide will help you understand the basics. We'll go through the probate process, talk about ways to avoid it, and discuss selling property during probate in Texas to local home buyers.

Probate in Texas can be complex. Did you know that when someone dies without a will in Texas, their estate is distributed according to the Texas Probate Code? Or that selling real estate through probate can take up to six months, sometimes longer if there are issues?

Knowing these facts can help a lot when dealing with inherited property. Let's look at the main points you should know about probate in real estate in Texas.

Key Takeaways

- Probate is needed when the deceased person dies without a will in Texas to distribute assets

- The probate process usually takes about 30 days, but can take up to six months or more for real estate sales

- An Affidavit of Heirship may be used when there's no will

- Probate properties must be priced at least 90% of their appraised value

- Court approval is needed for finalizing probate property sales

- Working with a probate attorney can help navigate the complex process

What is probate in real estate?

Probate in real estate is a legal process. It makes sure the will of the deceased person is valid and distributes their assets. This is critical for managing an estate, especially when real property is part of it.

Definition and purpose of probate in real estate

Probate makes sure a deceased person's assets, like real estate (also known as real property in probate speak), are distributed correctly. It means collecting assets, paying off debts, and giving property to the right people. In Texas, estates worth less than $75,000 might not need probate.

What happens when someone dies without a will?

If someone dies without a will, their estate is called intestate. The Texas Probate Code then says how their assets get shared among their heirs. Sometimes, an Affidavit of Heirship is made to prove who the rightful heirs are. This can speed things up quite a bit, especially if you choose to sell the property to real estate investors without probate.

What is considered real property in probate?

Real property in probate includes things like houses, land, and other things that can't be moved. These items usually need probate proceedings. If a homeowner dies without a will, their property might go through probate sale to distribute these estate assets.

Importance of clear title and heirship determination

Getting a clear title and figuring out who the heirs are is key to selling probate property. This makes sure the right people get their share of the estate. It helps avoid disputes and makes transferring assets smoother.

- Probate costs vary based on state and legal representation

- Properties in probate are typically sold as-is

- The probate sale process can take over a year to complete

- Probate properties often sell at reduced prices

Knowing about probate in real estate is important for heirs and buyers. It's a detailed process that needs careful handling. It ensures assets are distributed fairly and property titles are clear.

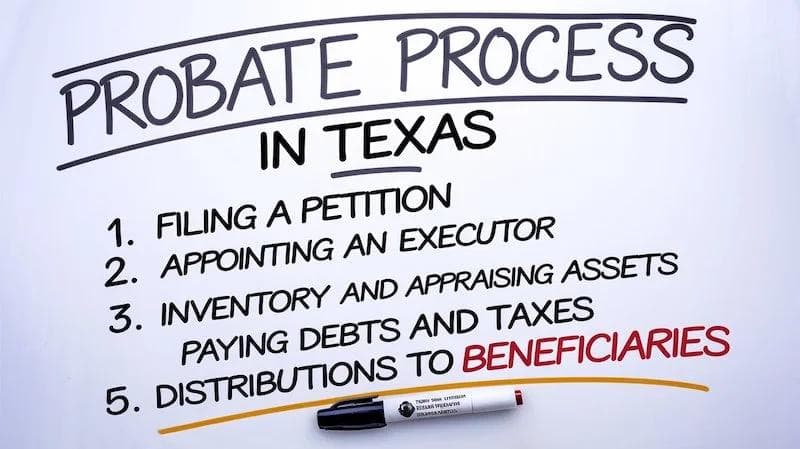

The Probate Process: From Filing to Distribution

The probate process in Texas begins with filing an application in the county where the deceased lived. This starts a process that can take from three months to several years. The time is usually dependent on the complexity of the estate and the amount of assets.

After the court says yes to the application, an executor or administrator takes over. They handle everything for the heirs or beneficiaries. They make a list of the assets, pay debts and taxes, and give what's left to the heirs.

- Identifying and appraising assets

- Managing the estate's finances

- Paying ongoing expenses

- Filing tax returns

- Addressing any disputes over the will

- Finding buyers for any real property and other assets

Some assets don't go through probate. They are said to bypass probate. These are life insurance policies and retirement benefits with named beneficiaries. Probate only deals with assets owned by the deceased alone.

According to Adair M. Buckner, Attorney at Law, "In Texas, if the deceased had a Will providing for an independent administration, which is standard for lawyers to include in a Will, the cost of probate probably would range from $750 to $1,500 in attorneys' fees. Court costs are about $380 in Texas. A more complicated estate might run slightly more in attorneys' fees, but it would be unusual for the fees to exceed $2,500."

In Texas, executors have four years to apply for probate. This time can be longer if there are will contests or trouble finding heirs. The court watches over the process to make sure everything is fair.

How to avoid probate in Texas?

In Texas, there are ways to skip probate when planning your estate. A living trust is a key tool. It lets assets go straight to your chosen beneficiaries without needing court approval. This saves time, money, and keeps your estate private.

"Is probate necessary when my husband dies?", Robin K. in San Antonio, TX asked us. This usually depends on whether assets were owned jointly.

Another way is through joint ownership. In Texas, property in joint tenancy or survivorship community property goes directly to the last owner. This works for things like houses and bank accounts.

Beneficiary designations are also key to avoiding probate. You can name beneficiaries for life insurance, retirement accounts, and annuities. When you pass away, these assets go straight to the people you chose, skipping probate.

For smaller estates, there's a simpler option. The small estate affidavit lets heirs claim assets worth $75,000 or less without full probate. This is quicker and cheaper than the usual probate process.

- Use a living trust to transfer assets quickly

- Choose joint ownership for automatic property transfer

- Designate beneficiaries for financial accounts and policies

- Consider a small estate affidavit for estates under $75,000

By using these strategies, Texans can make sure their assets get to their loved ones fast. This not only saves time and money but also brings peace of mind during tough times.

Selling a House During Probate in Texas

Selling a house during probate in Texas has its own set of rules and steps. An estate administrator has the authority to sell a house in probate but requires court approval for the final sale. The executor must follow these rules carefully to make the sale go smoothly.

Legal Requirements for Selling Probate Property

In Texas, selling a probate property needs court approval. The executor must apply to the court and get the property appraised. The sale price must be at least 90% of the appraised value, also known as fair market value.

Steps to List and Market a Probate Property

Listing and marketing a probate property is similar to a regular sale. A real estate agent can help list the property and draw in buyers. It's important to tell buyers the sale is subject to court approval.

- Obtain consent from all beneficiaries

- File a notice of sale with the court

- Send notice to all heirs

- List the property with a real estate agent

- Market the property to potential buyers

The Role of the Court in Approving the Sale

The court is key in the probate sale process. After an offer is made, a court hearing is set, usually 30-45 days later. At this hearing, anyone can bid on the property. New bids must be at least 5% plus $500 over the original offer. The highest bid, from the sale or the hearing, is accepted.

"Probate sales in Texas can take longer than traditional sales due to court involvement and procedural requirements." - Danny Johnson, San Antonio, TX

Working with an experienced estate planning attorney can help with selling a house during probate in Texas. They can guide you through the legal steps, the court approval process, and ensure you follow all the necessary steps.

Navigating Challenges in Probate Real Estate Sales

Selling a house through probate can be tough. Buyers often avoid these properties because of the long wait and uncertain outcomes. The condition of the probate property is a big reason why buyers hesitate. Executors might not know much about the house, making it hard to give clear information.

Keeping the property in good shape is a big challenge during probate. Costs for upkeep can pile up while the sale is being finalized. This can put a strain on the estate's finances and might lower the property's value.

When wills are contested, it adds more problems. Family disputes over inheritance can make the process take months or even years. Probate sales often take 6-12 months to finish, and some can take even longer.

- Delays come from will contests, missing heirs, and creditor claims

- Heirs may struggle financially during the long wait especially when a mortgage has to be paid by the estate

- Debates over asset value can lead to family conflicts

Working with experts who understand probate sales can make things easier. They can help you with tricky disclosures and keep the property in good condition. With the right support, you can overcome probate challenges and successfully close the sale.

One option many executors consider is selling the house to a cash home buyer. This provides several benefits:

- Cash offer to buy the house as is

- Closing within 10 days or when best for the heirs

- House does not need to be repaired

- Items the heirs do not want can be left in the house

How long does an executor have to settle an estate in Texas?

In Texas, settling an estate has its own timeline. There's no exact deadline, but executors must work fast. The probate court wants quick action, but each case is different.

The probate process in Texas usually takes six to eight months. Simple estates might finish in six months, but complex ones can take over a year. Executors have three years to settle everything, including paying off creditor claims.

- File for probate within four years of the testator's death

- Provide notice to creditors within one month

- Notify beneficiaries within 60 days

- File inventory and list of claims within 90 days

The probate court is key in overseeing the estate settlement. Executors must meet certain deadlines, like filing an inventory of assets within 90 days. This keeps everything clear and speeds up the process.

Remember, every estate is different. Things like estate size, creditor claims, and asset complexity can change the timeline.

Getting a Texas probate attorney can make settling an estate easier. They help meet deadlines, deal with creditor claims, and make sure assets are distributed right. Their help often makes the probate process smoother and faster.

We have another article with an in depth look at how long after probate a house can be sold.

Conclusion

Navigating the probate process in Texas real estate is complex. Yet, knowing the key steps is vital. With over 55% of Americans lacking estate plans, many properties end up in probate. This shows why getting legal advice and planning early is crucial.

According to LegalZoom, "Fifty-six percent of Americans believe that estate planning is important, but only 33% of adults in the U.S. have documented their end-of-life plans. Of the estate plans made in 2021, 75.12% were wills, 18.78% were trusts, and 6.1% of people nominated a guardian for their young children."

The Texas real estate market offers great chances for those in probate sales. Even though 11% of real estate deals face delays due to title issues, doing thorough title searches can prevent problems. Probate properties often sell for less than market value, drawing investors seeking higher profits.

Probate sales need court approval and must go through appraisals for fair pricing. In Texas, independent administration can make the process easier by reducing court oversight. For executors, beneficiaries, or buyers, knowing these probate process details can make transactions smoother in the Texas real estate market.

If you would like a cash offer for a house in an estate, whether going through probate, or without probate, Danny Buys Houses would like to make you a cash offer. Just give us a call or fill out the fast cash offer form!

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.