Can you sell a house in a trust after death?

By Danny Johnson | Updated 9/3/2024, 7:43:17 AM

Discover how to sell a house in a trust after death. Understand the tax implications and essential steps for managing a property within an irrevocable trust.

- Key Takeaways

- Understanding Trusts and Property Ownership

- Types of Trusts: Revocable vs. Irrevocable

- Role of the Grantor, Trustee, and Beneficiaries

- How Trusts Affect Property Ownership

- The Legal Process of Selling a House in a Trust After Death

- Step 1: Reviewing the Trust Document

- Step 2: Obtaining Necessary Legal Documentation

- Responsibilities of the Trustee in the Sale Process

- Selling a House in an Trust After Death: Step-by-Step

- Financial Implications of Selling Trust Property

- Capital Gains Tax Considerations

- Estate Tax and Inheritance Tax Issues

- Distribution of Sale Proceeds

- Challenges and Considerations in Trust Property Sales

- Potential Conflicts with Beneficiaries

- Market Conditions and Timing the Sale

- Maintenance and Repairs Before Selling

- Is it better to keep an inherited house or sell it?

- Emotional Factors

- Financial Considerations

- Property Management

- Skip The Repairs: Sell to a Cash Home Buyer

🗂 Table of Contents

Yes, you can sell a house in a trust after a death. We will cover the ins and outs of the correct process. First, it's important to remember why a house is in a trust in the first place. This was someone's wish and decision when they were planning their estate. If you are here because you want "someone to just buy my house", read on because we will share how you can sell to a cash home buyer to avoid costly delays in selling a house in a trust.

Losing a loved one is hard. The grief can feel overwhelming, making dealing with their estate seem impossible. As John W. expressed to us, "I remember when my grandmother passed away, leaving her family home in a trust. We felt lost, unsure what to do next." If you're facing this situation, you're not alone.

When you go to sell a home, dealing with trusts, estate planning, and selling property can be tough. But understanding the process can bring comfort and clarity. Let's look at how to sell a house in a trust after someone has passed away. We'll see what it means for you and the beneficiaries.

If you are looking to sell an inherited home that is not in a trust, you can find more in our article about selling an inherited house.

Trusts are widely used in estate planning, protecting assets and making property transfer easier. When someone dies, their trust is vital for managing their legacy. As a trustee or beneficiary, you might need to sell a house that is in the trust. This process requires some legal steps, tax knowledge, and respecting your loved one's wishes.

This guide will cover selling a house in a trust after death. Even if it is a house in an irrevocable trust or revocable trust, we have you covered. We'll discuss different trust types and the steps to sell trust property. If you're dealing with probate, inheritance taxes, or just wanting to honor your loved one's wishes, we're here to help. We'll guide you with confidence and care through this tough time.

Key Takeaways

- Selling a house in a trust after death is possible but requires knowledge of the trust type and terms of the trust

- The type of trust (revocable or irrevocable) affects the sale process

- Trustees play a crucial role in managing and selling trust property

- Tax implications, including capital gains and estate taxes, need careful consideration

- Understanding the trust document, or trust agreement, is essential before proceeding with a sale

- Beneficiaries' interests must be taken into account during the selling of trust assets

- Professional legal and financial advice can be invaluable when selling a house held in a trust

Understanding Trusts and Property Ownership

Trusts are common tools in estate planning and managing assets. They help with property ownership, offering benefits like protecting assets and planning for estate taxes. Trusts are great for ensuring what will happen with a house after the owner dies is more easily executed. Let's look at the main parts of trusts and their effect on property ownership.

Types of Trusts: Revocable vs. Irrevocable

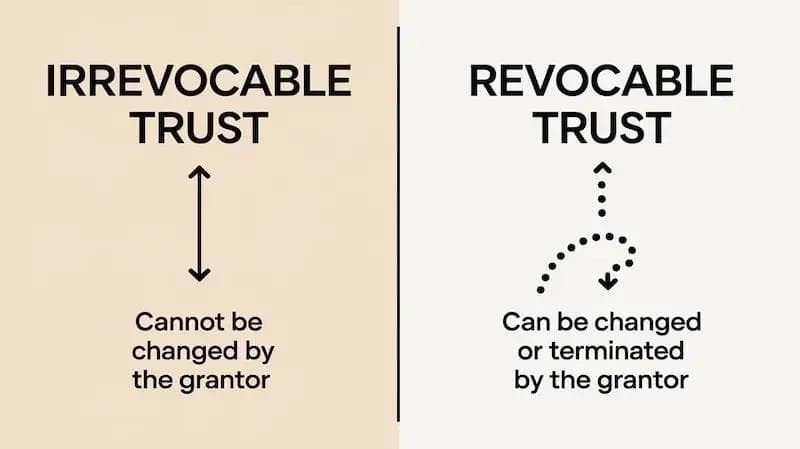

There are two main kinds of trusts: revocable and irrevocable. A revocable trust lets the grantor keep control over assets and change the terms. An irrevocable trust gives better asset protection and tax benefits but the grantor can't control the assets as much.

Role of the Grantor, Trustee, and Beneficiaries

The grantor sets up and funds the trust. The trustee takes care of the trust's assets, including any real property held in the trust. They have control over the trust.

According to Jana R. McCreary, a Houston estate planning attorney, "A trustee is a person or entity responsible for and with the authority for managing and administering your trust according to your instructions and in accordance with state law. They are considered a fiduciary (meaning they are held to a higher standard of care and owe certain duties to the beneficiaries)."

Beneficiaries get the assets or income from the trust. This setup makes managing and sharing assets easier. But can complicate the sale of a house that is in the trust.

According to Will Kenton at Investopedia, "A beneficiary of trust is the individual or group of individuals for whom a trust is created. The trust creator or grantor designates beneficiaries and a trustee, who has a fiduciary duty to manage trust assets in the best interests of beneficiaries as outlined in the trust agreement. "

How Trusts Affect Property Ownership

Trusts change property ownership by moving legal title from the grantor to the trust. This move affects taxes and asset protection. For instance, a Qualified Personal Residence Trust (QPRT) lets homeowners live in their property for a while before passing it to beneficiaries, which can lower gift taxes.

Beneficiaries in a testamentary trust might need to agree to sell a property according to trust provisions.

Knowing how trusts work is key when dealing with property and sales. It's smart to talk to a financial advisor to understand the tax effects and legal rules of managing trust property.

The Legal Process of Selling a House in a Trust After Death

Selling a house in a trust after someone dies is a complex legal process. It requires careful attention and is important to follow specific rules. Here are the steps for a proper home sale from a trust.

Step 1: Reviewing the Trust Document

The first step is to look at the trust document. This document explains the trustee's powers and duties. It tells if the trustee can sell property. It's important to check this document well before selling.

So how do you know if a trustee has the authority to sell the property?

According to Texas National Title, "The Texas statutes generally provide that a trustee of a trust has the power to sell, buy, encumber, and lease the property. The Trustee has a fiduciary duty to the trust beneficiaries in their management of the trust."

Step 2: Obtaining Necessary Legal Documentation

Next, you need to collect important legal papers. These include:

- Death certificate of the grantor

- Property-related bills

- Sale agreement (the agreement between the trust and a buyer to purchase the house for a specified amount)

These papers are key for a title search and finalizing the sale.

Responsibilities of the Trustee in the Sale Process

The trustee is key in the sale process. They must act for the good of the beneficiaries. This means:

- Getting the most profit from the sale

- Keeping costs low

- Making sure proceeds are fairly shared

Trustees can save up to 6% on commission by selling a house in a trust after death to cash home buyers. More on that later in this article.

This process can be tough. It's smart to work with an estate attorney and a real estate agent who knows about trust sales. They can help trustees follow the law and get the best results for the beneficiaries. If you are able to determine which attorney set up the trust, this person would be who I would want to talk to about the trust terms.

Selling a House in an Trust After Death: Step-by-Step

Selling a house in a trust after someone dies has several steps. First, you need to value the property. This is key to setting a fair price based on the current market. Experts are often brought in to find the home's true value. Cash home buyers can also make you an offer. If you get 3-5 offers, you will get a good idea of what the as-is, cash value of the home is.

Then, you must decide on repairs. Fixing up the house can make it more attractive and raise its price. The trustee should weigh the costs against the benefits of any improvements. If you sell to cash home buyers, you will not have to make any repairs. They will buy the house as is.

After getting the property ready, it's time to list it for sale. Hiring an agent who knows how to sell trust-owned homes is a good idea. They can help with the special challenges of these sales.

Next, you'll go through negotiations with buyers. The trustee must keep the beneficiaries' interests in mind. Once an offer is accepted, the closing process starts. This includes final paperwork and transferring the deed to the new owner.

- Conduct property valuation

- Decide on and complete home repairs

- Create real estate listing

- Negotiate with potential buyers

- Complete closing process and deed transfer

Keeping beneficiaries informed is important throughout the process. The sale money goes into the trust and is given out as the trust says. Following these steps makes selling a house in a trust after death smoother.

Financial Implications of Selling Trust Property

Selling a house in a trust has many financial factors to consider. Knowing these can help you make smart choices and avoid problems.

Capital Gains Tax Considerations

Capital gains tax is important when selling a house from a trust. The home's tax basis gets updated to its fair market value when the grantor passes away. This can greatly lower the tax burden for the heirs.

Estate Tax and Inheritance Tax Issues

Estate tax might apply if the estate is worth a lot. Each state has its own rules for inheritance tax. It's important to know these laws to avoid surprise costs. There might be a tax exemption, but it depends on your situation. When selling a house in a trust, it is important to talk to a tax professional about any tax implications of selling.

Distribution of Sale Proceeds

After selling, the trustee must file a tax return for the trust using Form 1041. The money should be given out as the trust says. Remember, the heirs might have to pay taxes on their share.

- Consolidate accounts for efficiency

- Consider market conditions before selling

- Seek legal help for complex tax implications

Selling a house in a trust can offer tax benefits, saving time and money on probate. Probate in real estate can take a long time and avoiding having the house owned by the estate avoid this. Another consideration is that If you need to rent out the house during probate things can get very complicated. If the house is in a trust, it won't be involved in probate. Working with real estate pros and tax experts can help you follow the rules and get the most financial benefits.

Challenges and Considerations in Trust Property Sales

Selling a house in a trust after death comes with its own set of challenges. Trustees must deal with complex issues to make the sale smooth. Let's look at the main things that can affect the sale.

Potential Conflicts with Beneficiaries

Beneficiaries often have different opinions on selling trust property. Some might want to keep the house, while others want to sell. Trustees need to find a middle ground. It's important to talk openly and honestly to prevent legal problems.

Market Conditions and Timing the Sale

The real estate market greatly affects when to sell. Trustees should keep an eye on market trends and get advice from experts. This helps them get the best price for the property. Things like the location, condition of the property, and sales of similar homes matter a lot. With the current real estate market stagnating with some declining prices, it might be important to sell quickly.

Maintenance and Repairs Before Selling

Keeping the property in good shape is key to drawing in buyers. Trustees might need to spend on repairs and upgrades to make the home more appealing. This could mean:

- Clearing all of the items out of the house after death

- Deep cleaning and decluttering

- Home staging to show off the property's best features

- Improving curb appeal with better landscaping and exterior work

By tackling these challenges, trustees can sell trust property smoothly. Getting help from real estate agents, lawyers, and accountants can make the process successful and legal.

Is it better to keep an inherited house or sell it?

Inheriting a house can be both a blessing and a challenge. You must weigh emotional attachment against financial considerations. Let's look at the factors to help you decide.

Emotional Factors

Inherited property often holds sentimental value. Childhood memories and family history make it hard to let go of a parents' house. Some people keep it to preserve these connections. Others prefer a clean break for emotional closure.

Financial Considerations

The financial side of keeping an inherited house is complex. Here are some key points:

- Tax implications: Inherited properties usually get a step-up in basis. This can reduce capital gains taxes if you sell.

- Maintenance costs: Older homes can be costly to maintain.

- Rental income: Renting the property can bring in income but requires responsibilities.

Property Management

If you keep the house as a rental, be ready for property management duties. This includes finding tenants, handling repairs, and dealing with vacancies. Many landlords spend 20% of rent on management and maintenance.

"Between 25% and 50% of rental income is typically lost due to vacancies, repairs, insurance, and management costs."

The decision to sell or keep an inherited house should match your financial goals and personal situation. It's wise to get advice from financial and real estate experts to make the best choice for you.

Skip The Repairs: Sell to a Cash Home Buyer

Selling a house after someone passes away can be tough. But, cash home buyers can make it easier. They offer a quick cash deal, skipping repairs. This is great when dealing with probate, which can take a long time.

Choosing an as-is sale with a cash buyer saves time and emotional stress. You won't have to fix up the house, show it to people, or haggle over prices. Companies like Danny Buys Houses can make a cash offer in 24 hours and close in 10 days. This is much faster than the usual probate process.

Cash offers might be less than what your house is worth, but they have big pluses. You dodge repair costs, agent fees, and ongoing expenses. And you get the money right away. For trustees wanting to speed up the sale and ease the burden on heirs, selling to a cash buyer is a smart choice.

AUTHOR

Danny Johnson

Owner and Founder at Danny Buys Houses

Danny Johnson is an experienced real estate investor who has been buying houses for cash since 2003. As owner of Danny Buys Houses, Danny's goal is to help homeowners sell their house fast, regardless of the situation, so they can move on with their life.

Danny has been featured in publications such as Forbes, Realtor.com, BiggerPockets, Yahoo Finance, US News, and more. He is also the author of the book 'Flipping Houses Exposed'.